Freshly squeezed blue orange juice

Cryptic ball: indeed, it was Pumplona.

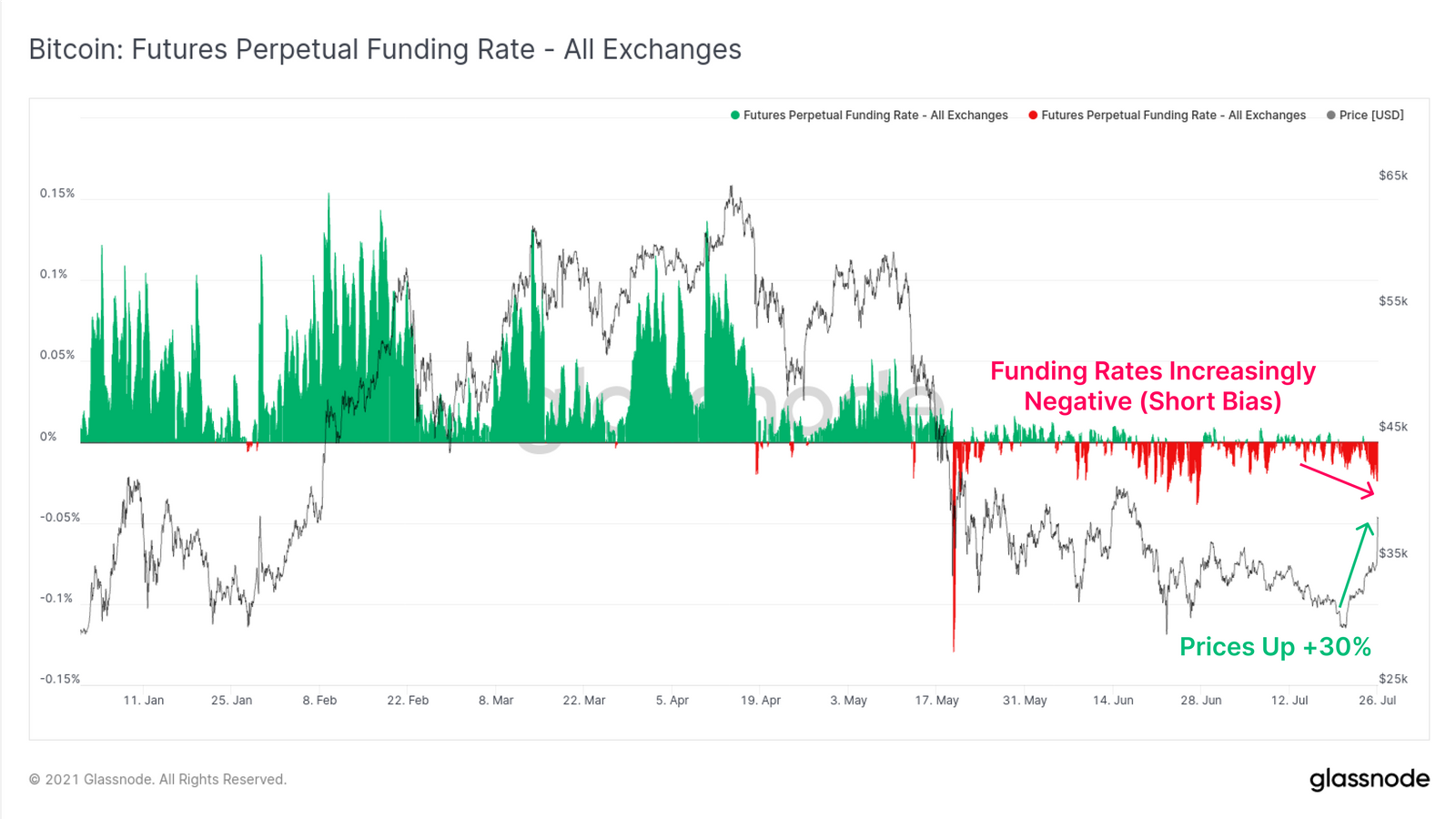

What a short squeeze. Bitcoin appreciated up to 25% since Friday's Pamplona newsletter was sent out. We told you the bulls would run and we were indeed gifted such a beautiful show. The stories of this weekend's gains will surely mark the end of summer, but we must remind you this bounce still only puts BTC back to its neutral horizontal channel. What happened and what can we expect next?

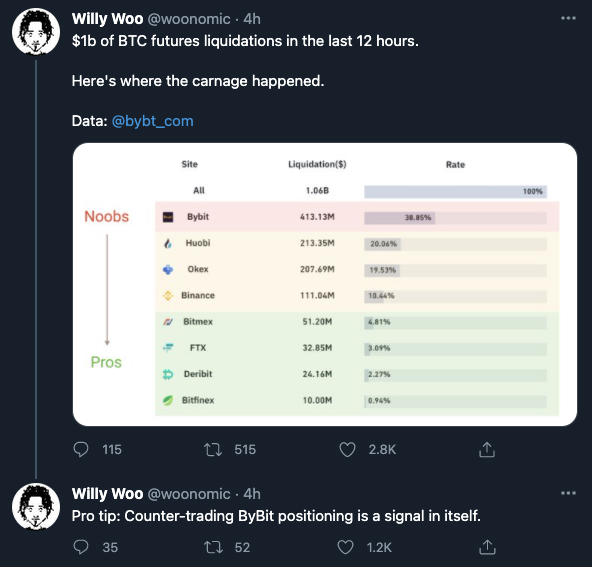

Well, after breaking the diagonal resistance explained last week, the orange coin managed to slowly ascend and test $35k Sunday morning. That first attempt failed, but bulls charged again shortly before midnight UTC and trapped leveraged bears who were running out of margin to keep their positions against bitcoin open. 15% was gained in the next three hours as the liquidation engines automatically closed a massive amount of shorts, which rapidly pushes prices as closing these positions requires buying back the asset that was being shorted in the first place.

Chart art: we told you bears didn't have a chance.

Market musings: Jeff Bezos is mining bitcoin on Mars.

What next then? Well, many are claiming that the pump was caused by rumours that Amazon will accept Bitcoin and a couple other alts for payments "by the end of the year" and is preparing to launch "its own token", at least according to an insider. The only truth to this is that Friday it was reported that the digital mammoth was hiring a "digital currency and blockchain expert". That's because the rumour only came out after the pump took place, and it was published by a small British newspaper, so it took even further for the word to go around.

In normal circumstances, one should buy into rumours and sell right before those news are confirmed. However, this is unlikely to be confirmed by Amazon so soon and the pump is already behind us. In other words, it would be very improbable that we keep climbing that much again this week. Yes, July's monthly close is next Saturday, but bitcoin is already above the critical level of $37.3k, which is June's open. It should remain that way, but for now we're expecting alts to catch-up!

Visual block: fuelled by a short squeeze.

Three things: metaverse and NFTs.

- Do you know what's "the past, present and future of art markets"?

- Do you want another great recap of what happened in "The B Word" event?

- Did you know Zuckerberg is turning Facebook into a "metaverse company"?

Tweet tip: guess most bears were trading in China.

Meme moment: this could be true, you know!

B21 Metal Cards: coming this Tuesday.

Get started: download the B21 Crypto app!