Buckle up (or down)

Cryptic ball: oh Arthur, dear Arthur.

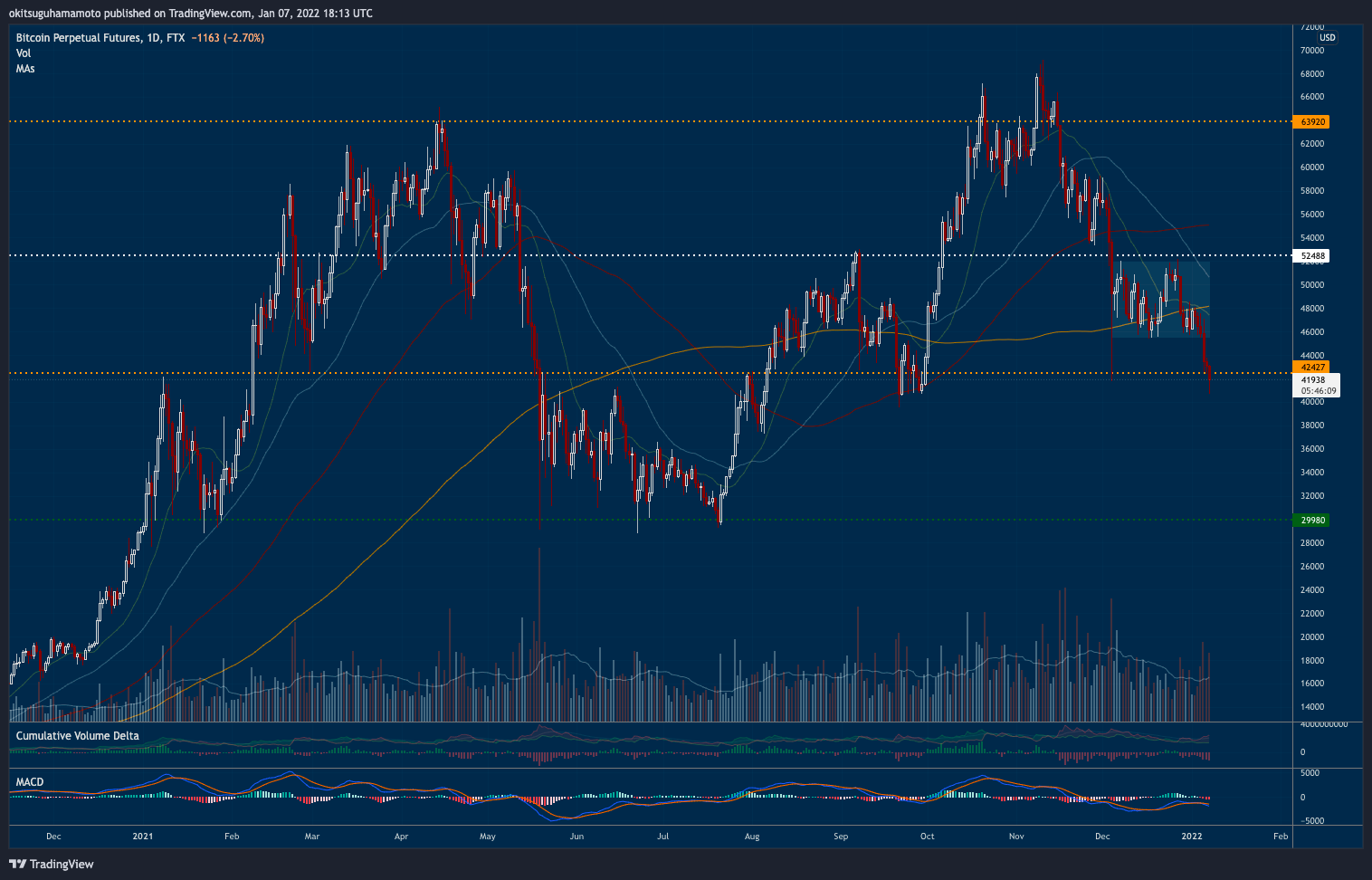

What a day! Volatility is back and crypto is fun again, right? At least if you sold early, or read yesterday's newsletter, which anticipated today's break of $42k and the weak bounce at $40k. Meanwhile, for those of you who didn't, not all is lost. After all, ATOM barely felt the increasingly scary dip and just tested its September all-time high. But one alt's strength doesn't compensate the rest of the market (fine, LINK and ONE are also strong, but three isn't a crowd).

And it's not just crypto, most global markets look shaky, so I hope you have finalised your plan in case things go south of Antarctica. If you recall, yesterday I explained that I had changed my stance for the year ahead. In 2021 I often argued we would see a top in Q1 or Q2, as I was expecting the Fed to prolong the party a few months more. But the music stopped and it seems at least Q1 will be quite bearish - even if maybe this is not bad for trading provided we have volatility.

Meanwhile, if you didn't understand this shift, let me recommend you a post from Arthur Hayes for the 19th time since I've started writing this daily digest. The former CEO of BitMEX has a great record of getting macro plays right, and today he shared his latest thoughts, which complements the scenarios I've been sharing with you. In brief, he is also anticipating a major drawdown as central banks fight inflation. It's possible we're wrong and we're close to a bottom, but catching falling knives isn't fun and if the market bounces we can get back in quickly.

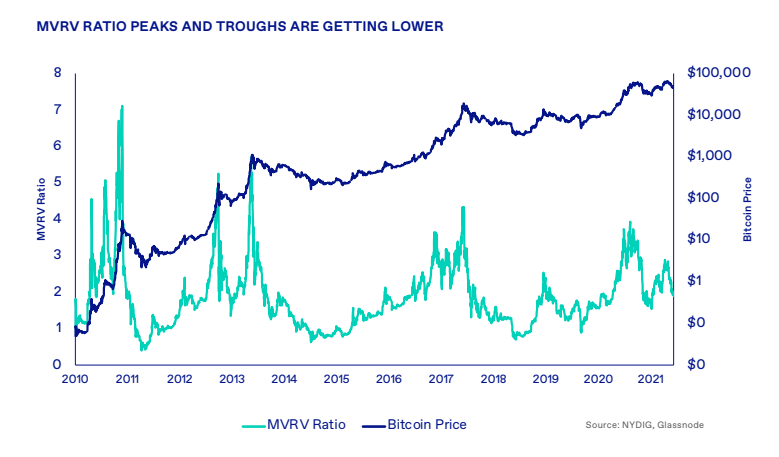

Why such gloom? Because central banks are increasing interest rates, which raise the cost of borrowing money around the world, which makes risky assets less sexy. In other words, things will get worse before they get better. But there's a bright side to this. It could be the case we're indeed fulfilling the supercycle thesis. I continue to believe we haven't seen the top of this crypto bull cycle, at least if we are to expect the long booms and busts that used to dominate this market.

Instead, crypto is just taking a beating, just like risky equities are also suffering. Now, how long can this last? Arthur goes deeper into these scenarios than I, but to put them simply it's possible that inflation wanes off after March or that the US stock markets go into bear market territory (30% dip for them). That would be good for crypto, as any of those would allow the Fed to turn the money printer back on and then risky assets can thrive again.

Even today we saw a glimpse of that possibility. US jobs data came out and it was half the forecast - which shows the real economy hasn't recovered as much as the politicians in charge want it to. Still, the Fed will likely only ease up on this once inflation is tamed and the mid-term elections in the US are "controlled". Meanwhile, I'm pretty sure the S&P 500 will continue falling next week. This means Sunday we may see another ride down in the crypto carousel. Buckle up!

Chart art: oh ranges, dear ranges.

Three things: oh mistakes, dear mistakes.

- For those who scroll down, don't miss Arthur Hayes' scenarios.

- For those who prefer Bitcoin, don't miss Nic Carter's report on the future of its carbon emissions.

- For those who make trading mistakes, don't miss Darren Lau's review of his trading activity ups and downs.

Tweet tip: oh bears, dear bears.

Meme moment: oh perspective, dear perspective.

B21 App: oh profits, dear profits.

Get started: download the B21 Crypto app!