OFACH

Cryptic ball: oh, dear.

What a shame! After yesterday's recovery, bitcoin and most alts lost all those early weekly gains in the first hours of the morning, UTC time (which is all that matters in these 24/7 crypto markets). BTC lost 3% and ETH 5%. What's next?

- The pullback hasn't harmed BTC's uptrend formed in June - yet. It isn't a clear failure to create a new higher high since July 30's attempt to conquer $25k, but it's close. So bulls need to recover ground quickly or else bears will attack.

- Ether's picture looks nicer. Yesterday we saw indeed a higher high, as in the end of July we were still trading at $1.7k and yesterday bulls briefly conquered $1.8k. Still, more conviction would be nice if we want to pump it for the Merge!

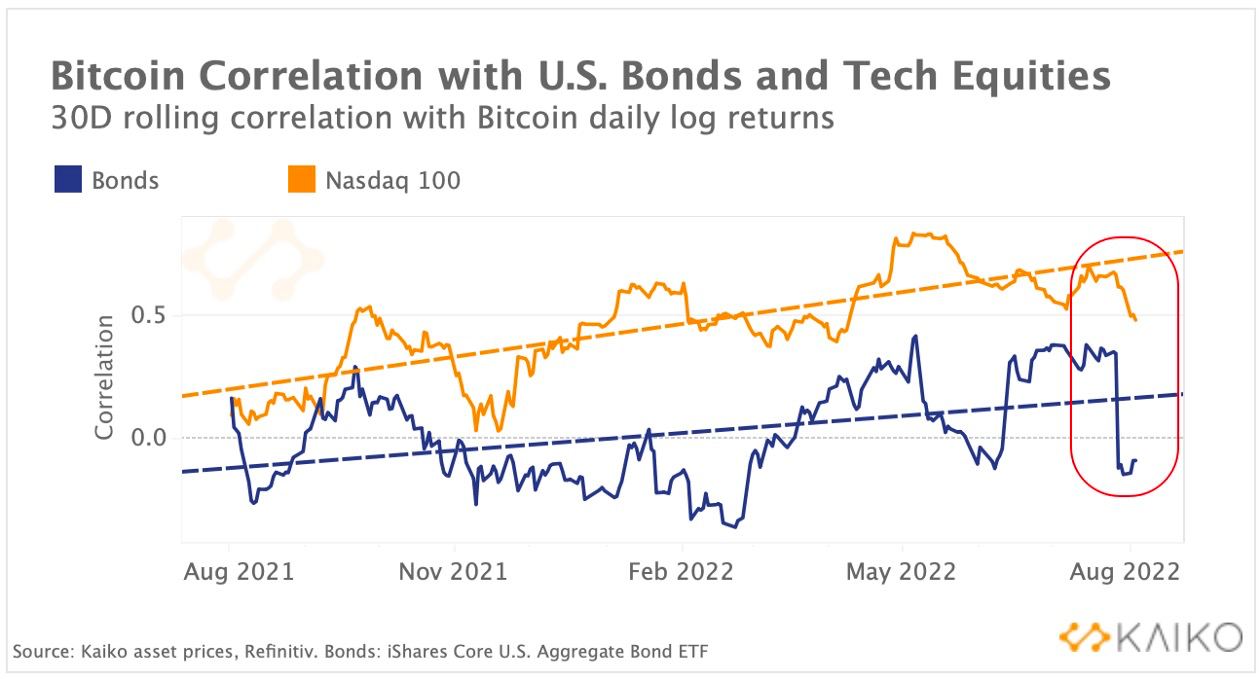

- Overall, I don't think we have a reason to be alarmed - just cautious. After all, crypto's dip comes on top of an equivalent downfall in US equities, as chip stocks reported poor earnings and profits are what fuels a bull run, right?

- As the Merge narrative keeps building, I'm expecting the rest of crypto to follow ether's journey to a more environmentally-sustainable and less jaw-dropping moon. At least as long as BTC doesn't fall below $22.5k - that'd be a setback!

- In the meantime, I'm continuing to think about the fight between bulls and bears in the stock market. Headlines like "Wave of Analyst Optimism Is a Red Flag to Citigroup Strategists" make me weary of the meta game being played.

- Remember that trading is a "Keynesian beauty contest", meaning one must consider why these "strategists" are criticising the "analysts". And then even if one group has access to better information than the other!

Overall, while currently the fear of recession in the coming years is real, we can't forget policy makers will adjust their game plan to mitigate it. So we must keep our thoughts as fluid as water in order to surf all the upcoming opportunities ahead!

Chart art: oh, bruce.

Three things: oh, noobs.

- Vitalik suggested a novel mechanism to ensure privacy in NFT trading.

- ZachXBT caught two teenage scammers who used Tornado Cash.

- Bizyugo details the plans for the next two big decentralised stablecoins.

Tweet tip: oh, north.

Meme moment: oh, boring.

FV Bank: new monthly newsletter.

Get started: download the B21 Crypto app!