Friday the 13th

Cryptic ball: don't be afraid of the weekend.

Bitcoin and ether are forming a new short-term range, having traded in the same tight interval since Monday. This solidifies the current key support level described Wednesday and, as explained last Friday, it gave confidence to degenerate traders to cycle their profits from these market leaders into alts - with many projects up 10% to 15% over the past 24 hours. But what can you expect for the weekend?

Well, NFTs continue to rock, literally (haven't you heard about the latest EtherRock fad?), helping some lucky collectors to walk their profits like a penguin, again, literally. And such activity helps prolong the current end-of-summer hype. Moreover, equities in Europe and America have also been pumping hard (with Europe posting gains unseen since 2017 and the US finally calm about inflation), so we don't expect much volatility over the next days. It's still August after all.

Chart art: don't be afraid of pet rocks.

Market musings: don't be afraid of optimism.

Zooming out, it seems we're in the disbelief or hope phase of this new leg of the crypto market cycle. Bitcoin accumulation is clear, as you can see below, and the stories of recent profits will bring back those who failed to buy the dip. Still, despite the recent optimism, we must remind you that central banks can still ruin the party later this year, which is slightly earlier than expected. Why?

Because tech stocks and other speculative stonks have also appreciated, but are showing signs of weakness. Talk of a "melt-up" is becoming more common, which means that such an unsustained rise can continue due to FOMO. That's great for crypto, as a warm stock market will ignite all bulls. But it will also attract attention from the US Fed and ECB, pushing them to resume tapering talks.

So, in addition to scouting for illiquid NFTs (like that "$1.5 million ‘women-led’ NFT project which was actually run by Russian dudes" and hunting for sheepcoins (like the latest Solana DEX, Mango, and its MNGO token; or AXS after being listed in another popular exchange), consider taking the next quiet weeks to further study that narrative. As usual, we'll do that and keep informing you, but DYOR.

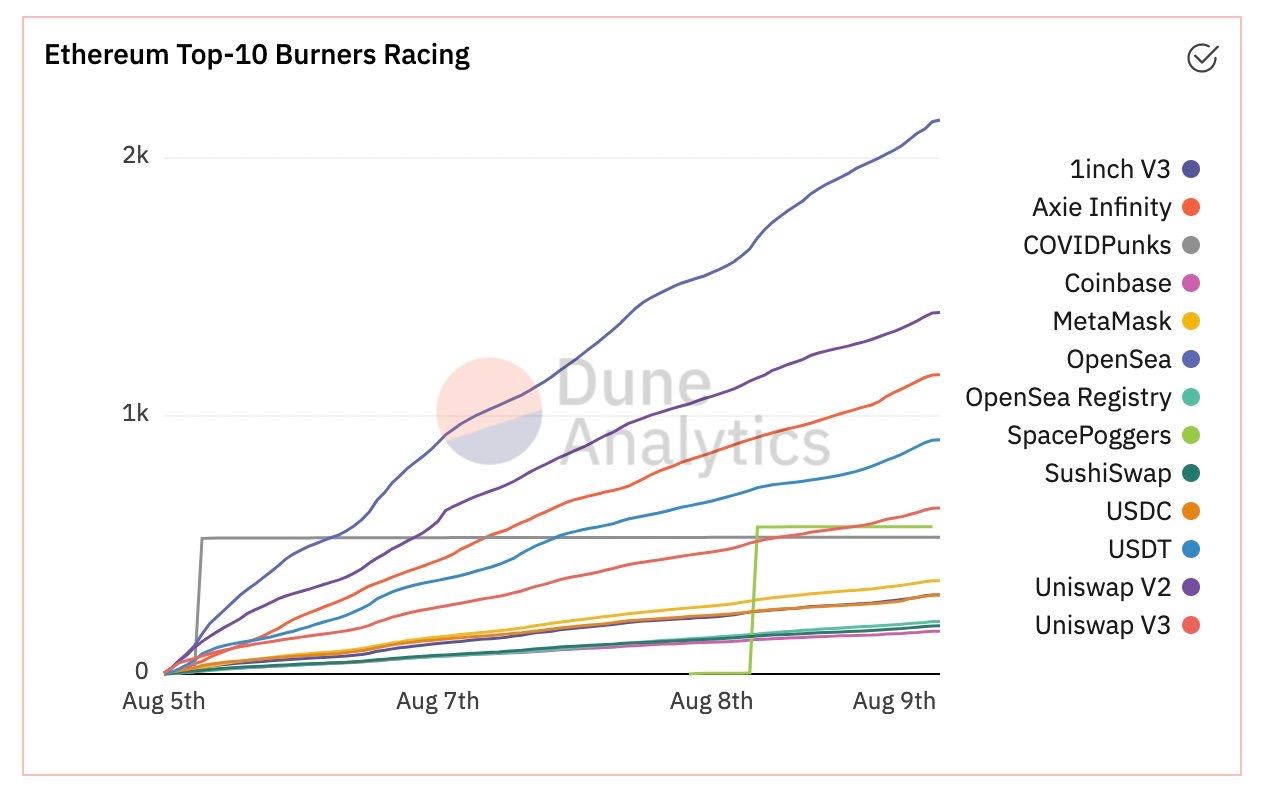

Visual block: don't be afraid of on-chain research.

Three things: don't be afraid of web3.

- Chris Dixon, from a16z, explains how crypto networks will overthrow incumbents. It's similar to the reasons why internet startups succeeded.

- Luke Posey, from Glassnode, explains how you can find value in DeFi governance tokens using on-chain data in a post EIP-1559 world.

- Spencer Applebaum, of Multicoin Capital, explains why "the future of finance is real-time reporting", exploring their deal with Dune Analytics.

Tweet tip: don't be afraid of the flippening.

Meme moment: don't be afraid of the bogeyman.

New token on B21: welcome, Polygon!

B21 Rewards: an announcement.

Note that starting 7:30am UTC, August 11th, 2021, all the referral and sign-up rewards in the B21 app will remain locked in your account for 90 days.

Get started: download the B21 Crypto app!