Implicit Coinbias

Cryptic ball: powered by red bull.

Well, it seems the weekend liquidations we wrote about yesterday were, after all, sufficient to propel bitcoin to another all-time high. The original cryptoasset is currently approaching $64k and ether has always climbed to a record $2.3k! Both are trading roughly 6% higher than yesterday, which compares with an average appreciation of "only" 3% for the following 98 of the top 100 tokens. Still, dogecoin and XRP pumped 30%, and 10 other alts appreciated more than 10%!

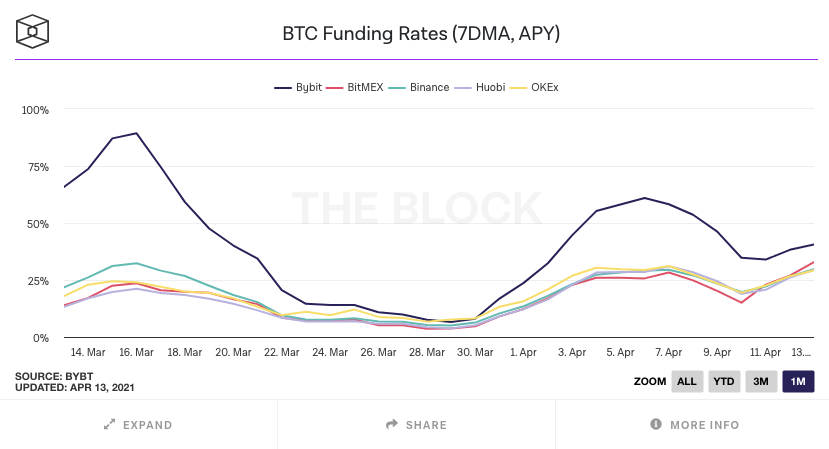

This is normal, as whenever the two crypto leaders pump, the majority of alts tend to either dump or, in such bullish situations as these, at least go sideways for a while. But what caused the move? There weren't any major news changing the fundamentals of the cryptospace, aside from Microstrategy - a firm that is popularising Bitcoin among institutional investors - announcing it will pay their directors in everyone's favourite form of digital gold, and Coinbase's IPO April 14th date approaching. Which means that the continued spike in funding rates, as shown below, implies this move was a technical breakout of the range we were in for the past 28 days - which could finally take place because all the bears got liquidated over the past days. Now, what can happen next?

Chart art: follow the funding.

Market musings: what will the Coinbase IPO do?

As usual, our readers want to know what will likely happen next. We can't predict the future, but after consulting our cryptic ball we may muse about the ongoing alt season. We've been talking about it since the early days of this newsletter and want to make sure you understand its nature. While we maintain our opinion that the rest of 2021 will remain bullish, it's important to be weary that not all tokens will benefit from double-digit pumps every day - remember coil springs often break.

In other words, if bitcoin's anticipated test of $60k happens anytime soon - something which could happen tomorrow (with very low probability, given that many traders want to long any re-test of $61k) in case Coinbase's listing goes against the hyper-bullish market expectations - then BTC's gravity would also drag down those same alts for at least a couple of days. If you recall, in 2017 everyone reacted euphorically to the launch of the first institutional bitcoin futures contract, by CBOE on December 10th. Then, on December 18th, when CME, the world's largest futures exchange, launched their own, highly-anticipated contract. As this didn't excite bulls enough (because they had bought the rumours and sold the news), bears took the chance to scare everyone, crashing BTC from $20k to $15k in just three days and then to $10.8k in the next three. Yes, alts pumped for another month after this, but that moment was deemed as the start of the bear cycle.

While we don't believe Coinbase's listing bears resemblance to 2017, pun intended, it's always good to catch up with history. And keep your eyes open for what could be the jubilation moment of 2021 which finally exhausts bulls. Meanwhile, if you're investing in an alternative cryptoasset be sure to measure its performance against BTC or ETH. If the token moved 3% today but the leaders moved 6%, then you're down 3% against this space's quasi-indexes. And, if you're playing with leverage, get familiar with the story of Archegos Capital, shared last week, as this fund lost $20 billion in two days last March! Be careful or risk losing all your bags too!

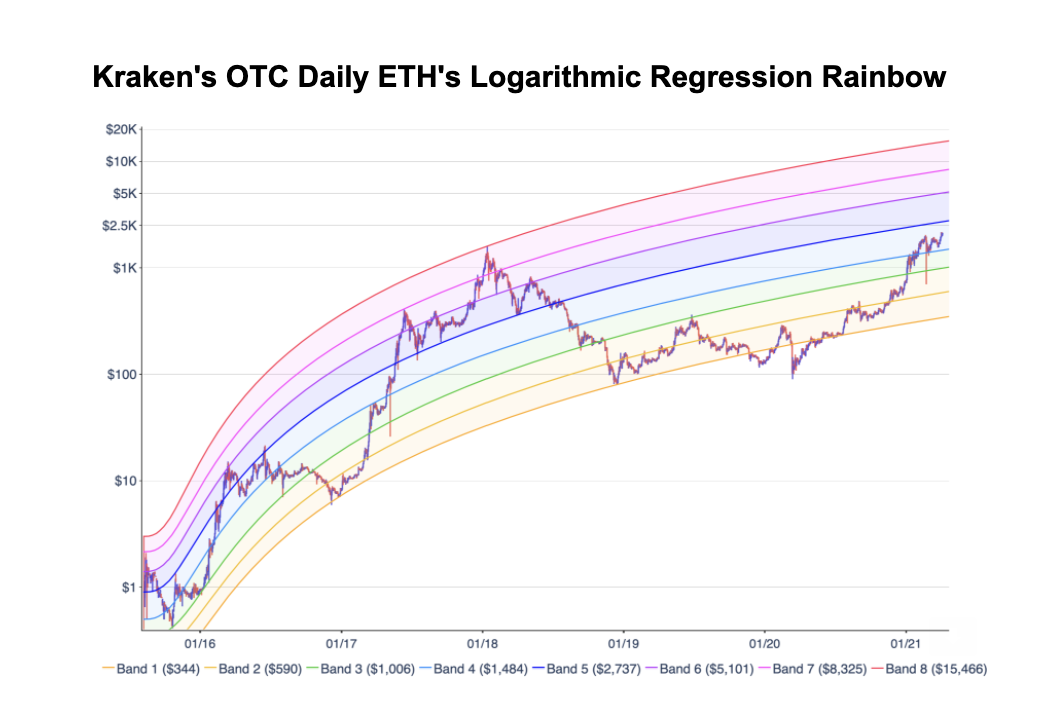

Visual block: in the long term we're all red (bulls).

Three things: what does probable mean in 2021?

- Do you struggle to understand Coinbase's expected $100 billion valuation? Check some arguments on why that should be a "mathematical improbability".

- Do you struggle to understand cryptoasset valuations? Check Lex Sokolin's latest attempt at explaining the mechanisms behind the high prices.

- Do you struggle to understand why regulators don't just ban Bitcoin? Because even a former CIA director agrees Bitcoin is great at fighting crime.

Meme moment: don't take the blue pill.

Email eagerness: add us as a contact.

Get started: download the B21 Crypto app!