We meant it

Cryptic ball: ether's ATH means alt season.

As anticipated in yesterday's newsletter, if ether were to confidently break it's all-time high, that would be a clear sign that alternative cryptoassets would spring. That happened some hours ago, and the bullish momentum will likely be confirmed after the daily close, at midnight UTC. Analysts are speculating the move was likely sustained by institutional buying, given large outflows from Coinbase, a popular exchange. So, if ETH is pumping, why are we bullish on alts?

That's because transfers in the Ethereum blockchain are currently very expensive, also near an all-time high, with an average fee of $22 as of today. That's due to high-demand for decentralised exchanges and other DeFi projects which are clogging the network. Developers are trying to scale it to bring costs back to earth, but while that doesn't happen, alternative blockchains will have a claim to a more efficient digital value ecosystem, and alts will attract more and more investors. So, keep an eye on BTC's dominance and watch out for a volatile weekend.

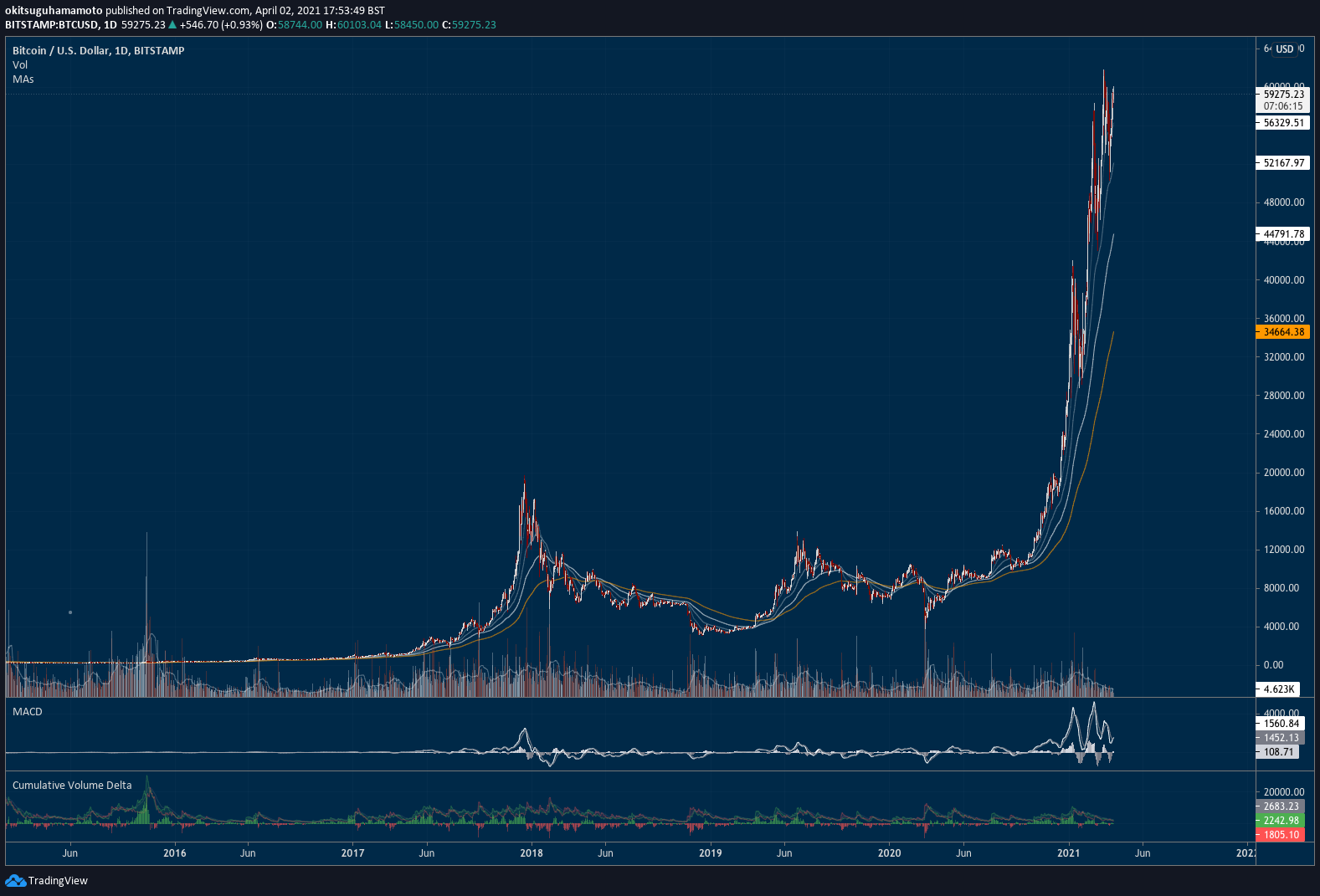

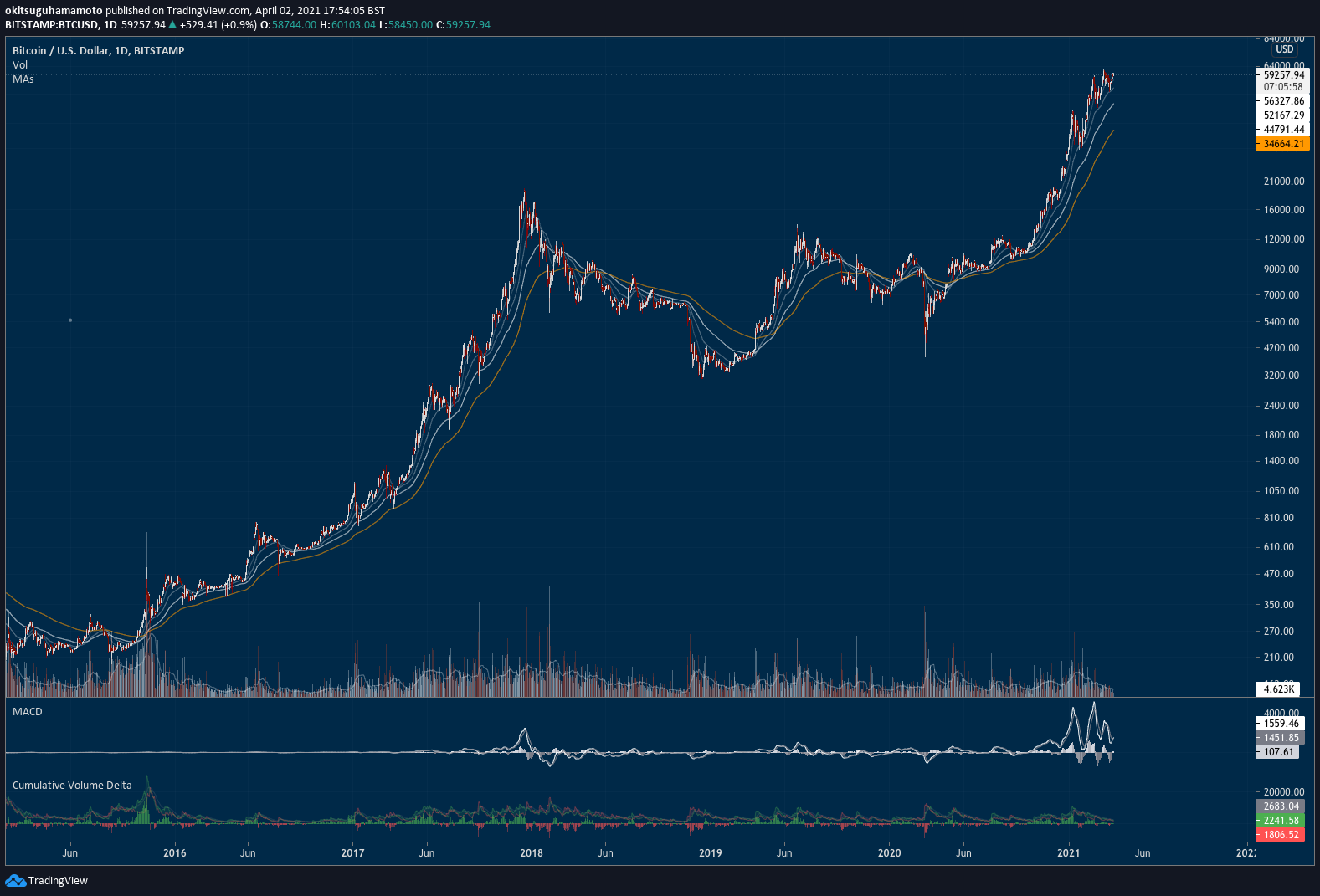

Chart art: same, but different meanings.

Macro musings: reversion to the mean.

It's cute how big banks can't resist a nice trend. After Goldman and Morgan Stanley's announcements in the past few days, it was JP Morgan's time to try to shine. The once bearish institution issued an update to its long-term target for digital gold from $146k to $130k, given it had originally valued bitcoin based on physical's gold price - which has fallen roughly 15% since last August.

Such valuation relies on a decline in volatility to enable more institutions to feel comfortable adopting the original cryptoasset. Naturally, that isn't going to happen soon. But such price targets anchor market expectations, so it's very likely we see bitcoin going up to that value and perhaps even beyond, still in 2021. Needless to say, if that happens you should expect similar 70% to 85% dumps from the new top as the ones felt in 2018 and 2013. If that doesn't happen, you should also expect such nerve-racking falls, albeit it's possible they'll be less extreme now.

Visual block: we're just being mean here.

Three things: we hope Coinbase's listing means alt season.

- Michael Saylor, Microstrategy's popular CEO, launched a new website for their Bitcoin resources: hope.com.

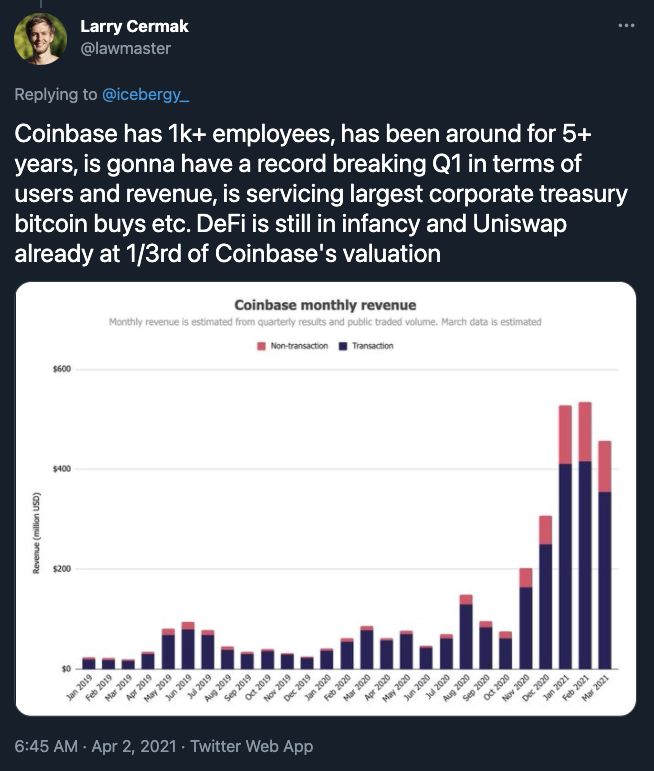

- Coinbase announced it will be directly listed on the Nasdaq on April 14th. The question is at what price.

- Daniel Jeffries just published this weekend's recommended reading: a "poor man's guide" to the upcoming alt season. He's a solid guy!

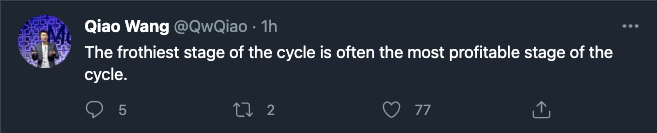

Tweet tip: frothiest means not serious.

Get started: test our new app!