Reversion to the meme

Cryptic ball: with great power.

As explained yesterday and last Friday, with great volatility comes great stability. And that was what we had today. Reversion to the mean is playing out as anticipated, with total market cap up 4% since yesterday, and with bitcoin and ether nearly testing $40k and $2.9k this morning, UTC time. Meanwhile, talking about means reminds us that B21 has also launched a meme contest - scroll down to learn how you can earn $100 by creating funny, original content!

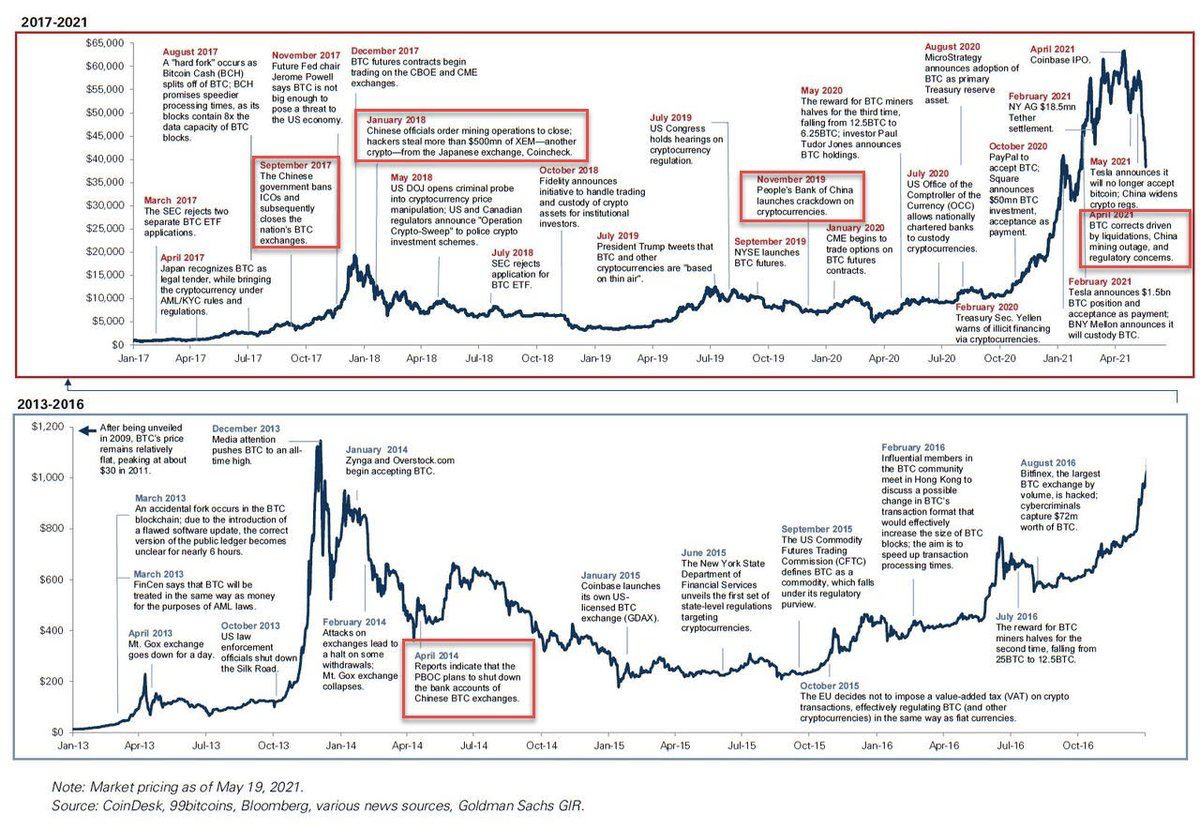

Back to the markets, you can see below that BTC and ETH have been moving in tandem, having just achieved a 90-day correlation record this year. Such relationship typically rises during market dips or crashes. This means that, until this interdependence changes, we'll likely continue moving sideways. In other words, a drop in this crypto correlation could signal the bulls are back!

Chart art: comes great correlation.

Market musings: comes great memeability.

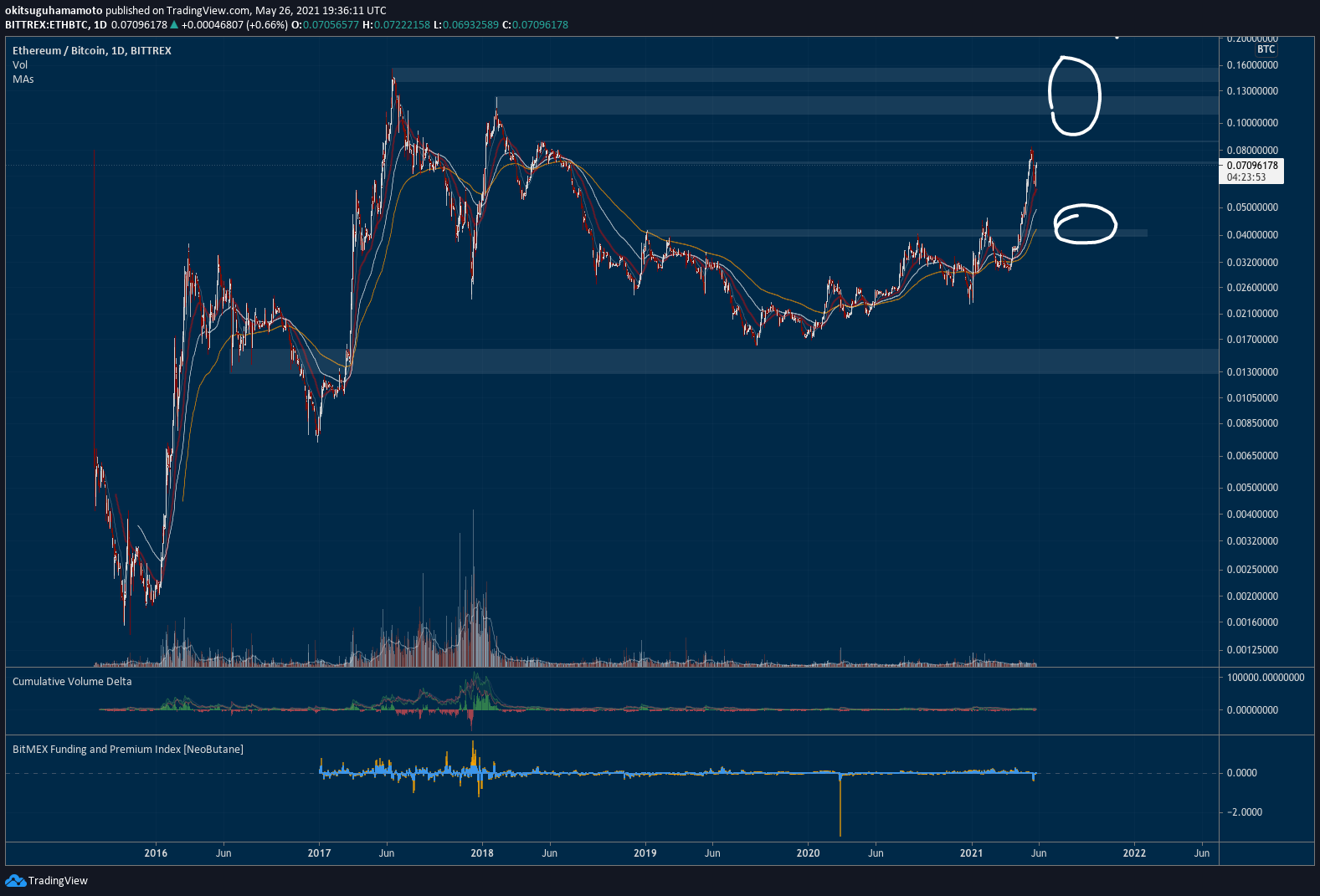

To further confirm this, keep looking at the ETHBTC pair - which prices ether relative to bitcoin and typically indicates alt season tops or bottoms. As illustrated above, if ETH's parabolic advance recovers the 0.08 level, it's likely we'll a test of 0.1 or even higher by July - before the summer blues kick-in and aligned with Ethereum's London hard fork momentum. This would be great for alts, even if bitcoin remains stagnant for a while. Conversely, we might be in summer mode already, meaning that ether (and alts) would slowly fade until investors come back from holidays, while BTC recovers.

The other side of the coin is that neither of the above scenarios can play out if both cryptoassets continue falling together. That would mean we're in a bear market, but your correspondent doesn't share that view. Why? Because the past weeks have been so wild. Noobs and pros alike were shaken to their core. Unless something triggers fresh buying or selling pressure, it's likely we'll keep moving slowly - ideally slightly upwards - at least until Elon Musk feels safe shilling dogecoin again, after having finally refused the title of "Doge CEO"!

Visual block: comes great rhymability.

Three things: comes great resilience.

- Glassnode Insights argues DeFi protocols sustained the recent crash quite well, given that many anticipated this space would suffer a liquidity crunch.

- Raoul Pal argues cryptoassets passed the recent shock test with distinction given that nothing failed except leveraged speculators.

- Vitalik Buterin argues "blockchain voting is overrated among uninformed people but underrated among informed people". It's all about the long term!

Tweet tip: comes great capitulation.

Meme moment: comes great responsibility.

#HODLandEarn - Celsius x B21 Meme Contest: check it out.

COVID Crypto Relief Fund: made with help from B21.

Email eagerness: add us as a contact.

Get started: download the B21 Crypto app!