Hopium Diaries - Dystopian Memes

Cryptic ball: keep an eye on these tests.

Another relatively boring, but positive day in the crypto markets. Bitcoin and ether have printed higher highs and higher lows on the 1-hour chart, which indicates an uptrend and makes us believe both cryptoassets will soon test $42k and $3k, respectively. But remember weekends and monthly closes are typically volatile. Adding that with the current wrecked mood of crypto traders and you can see how the next days will likely define the sentiment for June and July.

Looking on the bright side of life, we've recently shared how Ray Dalio is bullish on bitcoin, how Elon Musk has calmed his tone down, and how the China FUD has been deconstructed. But we also had PayPal announcing it will soon finally allow its users to withdraw cryptoassets to external wallets, after first enabling crypto purchases last year. And now Carl Icahn, another top investor, claims he's considering an investment of $1 to $1.5 billion into crypto!

Chart art: keep an eye on the Fed's announcements.

Market musings: keep an eye on equity markets.

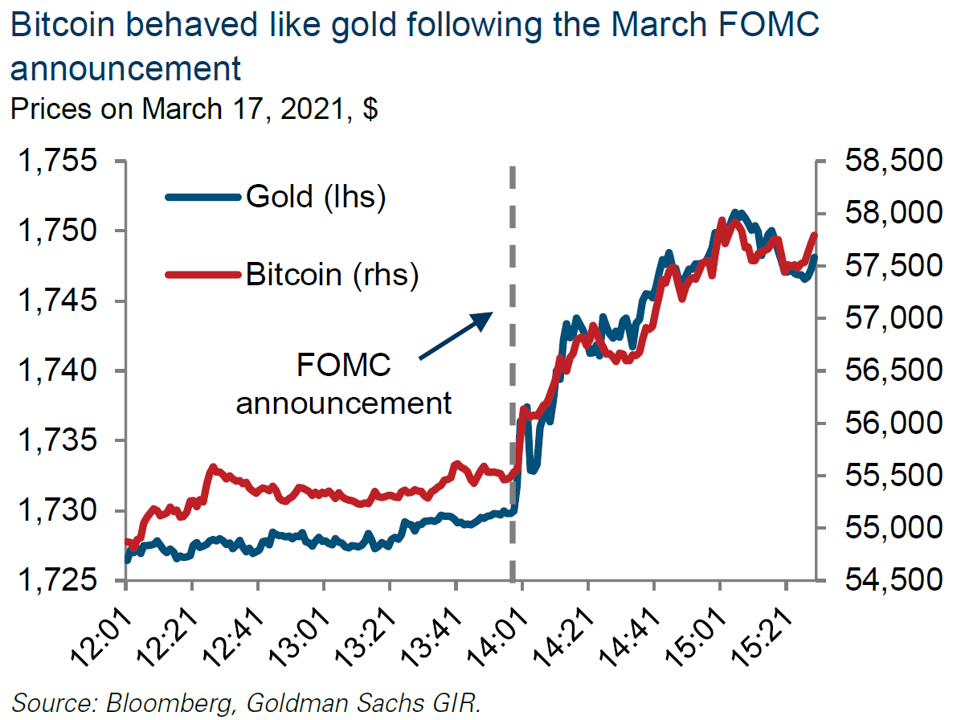

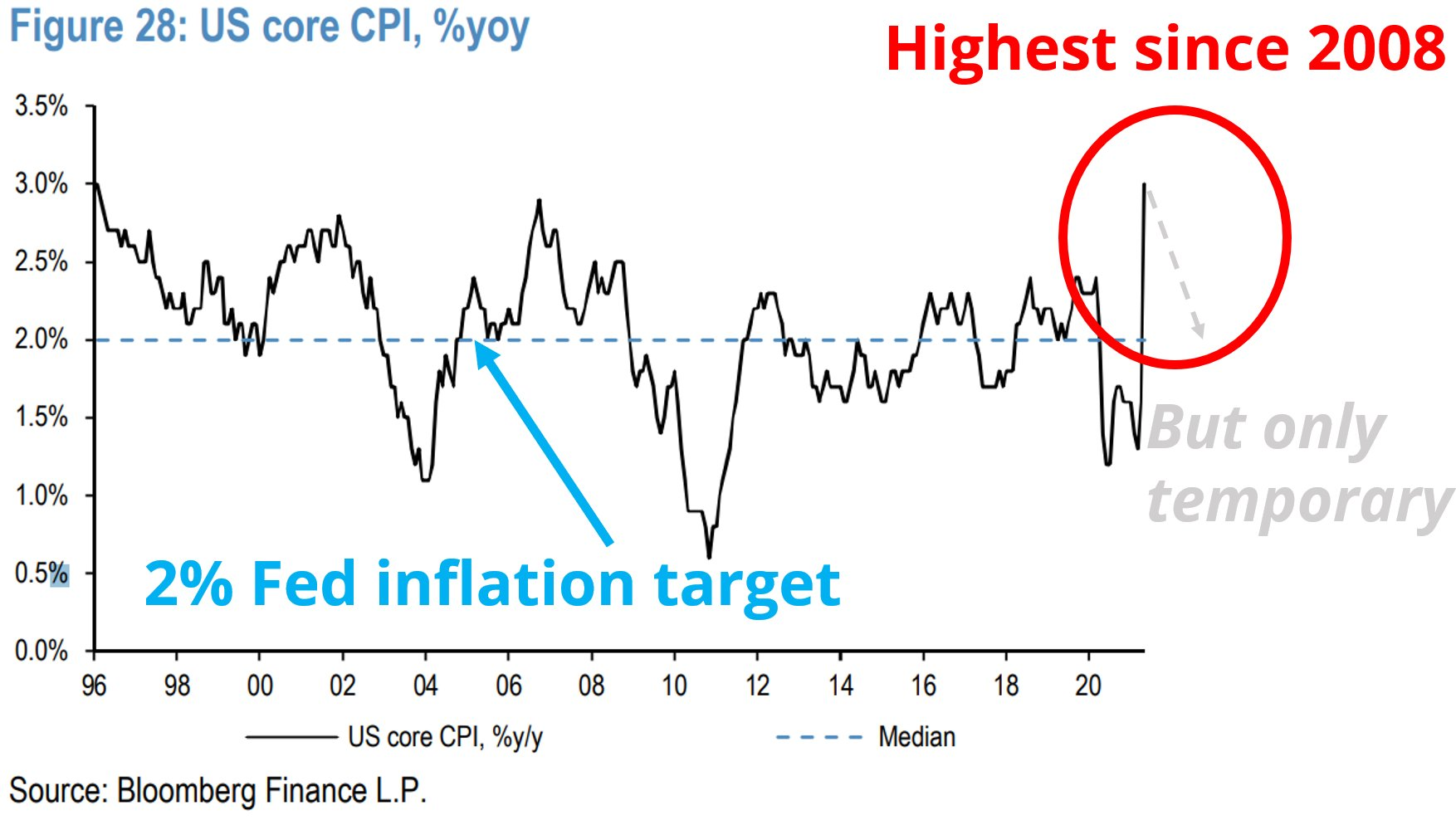

If we look on the bearish side of things, we can't honestly see much going on that we haven't already warned you about over the past weeks: namely the excessive amount of DeFi copycats and dogs, the occasional scams, and unanticipated FUD. This is probably related to our bullish bias, something we can't help. But there's one thing that has been worrying us which lies outside the space: global equity markets. As you can see above, both bitcoin and gold have behaved very similarly following speeches from the US Federal reserve.

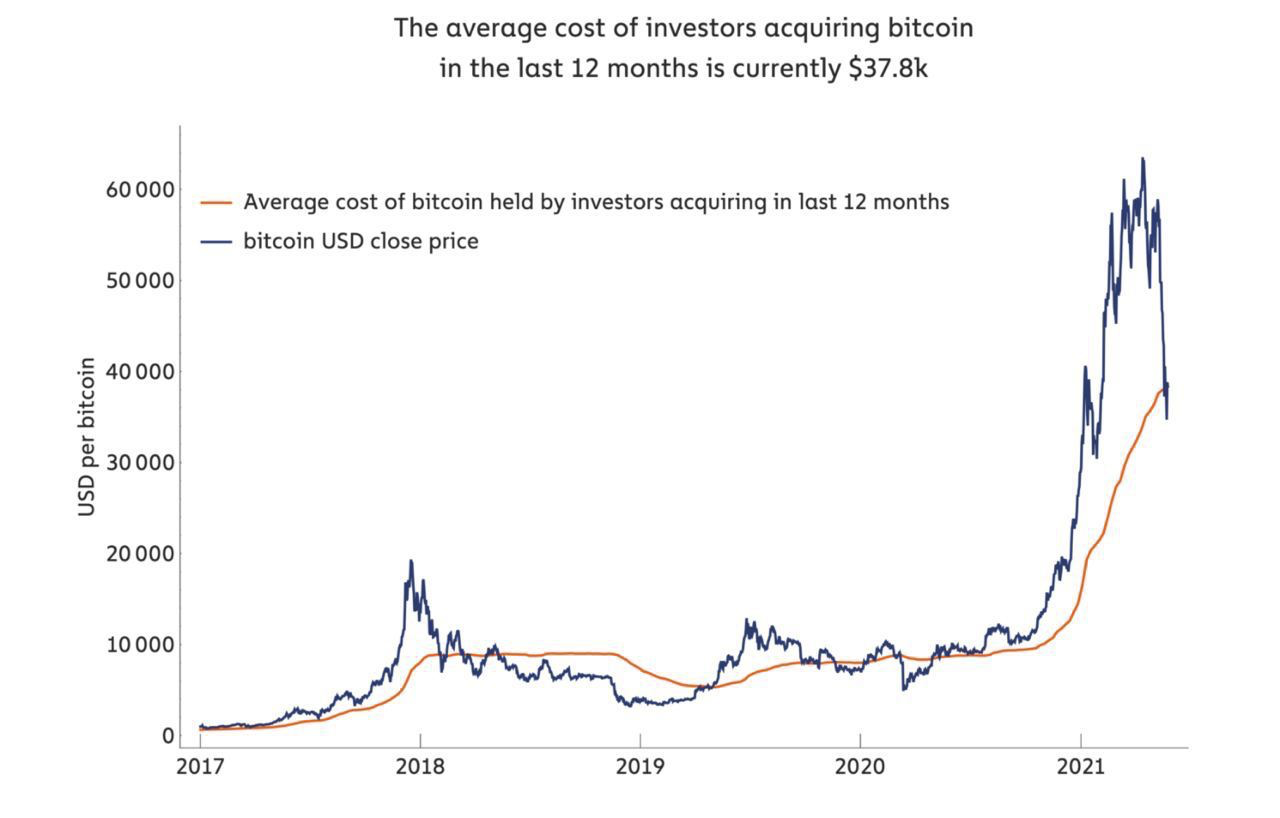

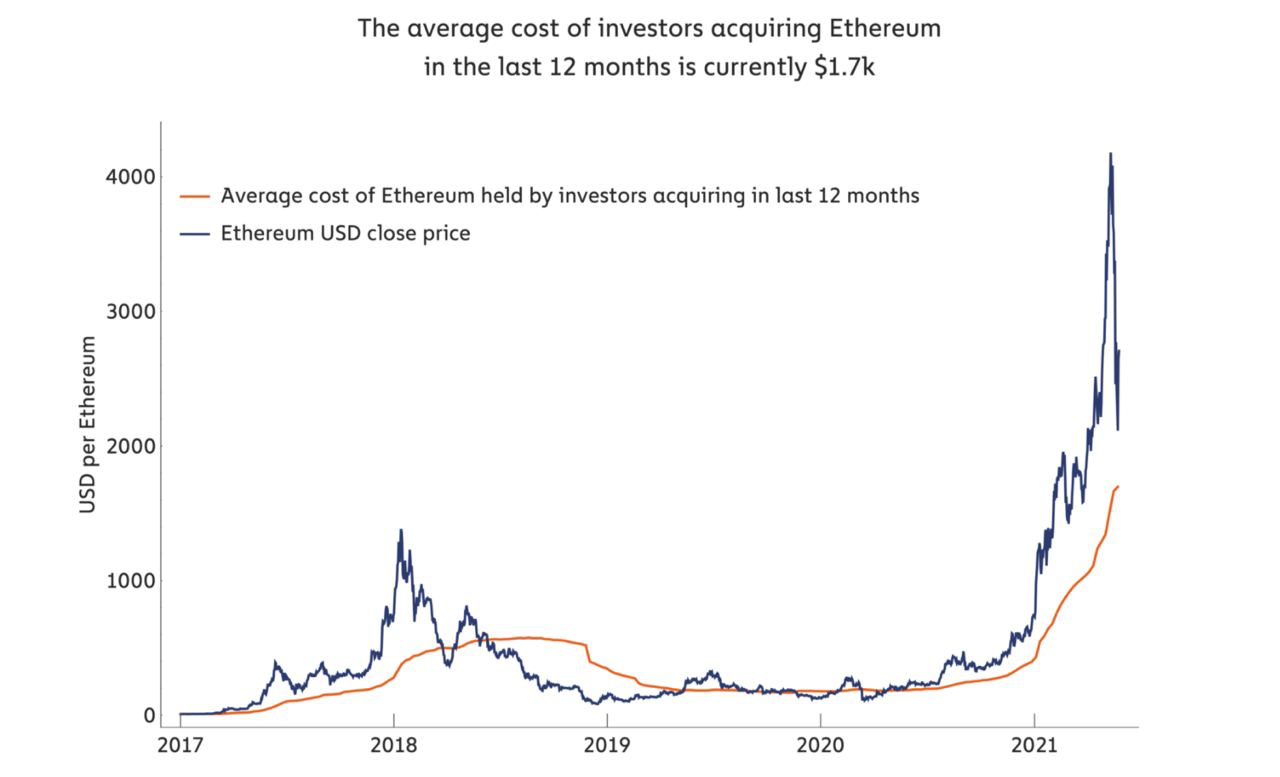

This means that if central banks decide to further halt the rise of stocks on account of inflation fears, cryptoassets would likely be affected too (remember March 2020?). Not even bitcoin's deflationary narrative could help it, at least in the beginning. However, the optimistic take here is that the post pandemic recovery doesn't heat up markets that much, and so central bankers wouldn't feel compelled to influence them. But who knows how such a complex system will play out. So, keep an eye on those macro matters, knowing that things move slowly on that front. In other words, it's likely that crypto bulls can continue running their course a while longer, even if we may see continued stagnation during summer, with prices finding a floor around the average costs shared below.

Visual block: keep an eye on these price floors.

Three things: keep an eye on the future.

- Messari's Mira Christanto just shared a thread on cryptoasset's relationship with the macroeconomic landscape. It's a must-read.

- Marty's Bent is a Bitcoin-focused newsletter that goes deep on important topics, yet it's brief and light to read. It just sent its #1000 issue!

- Julien Bouteloup's RektHQ released a 14-minute video that promises to change the future of DeFi. Hopium Diaries - Dystopian Dreams is a must!

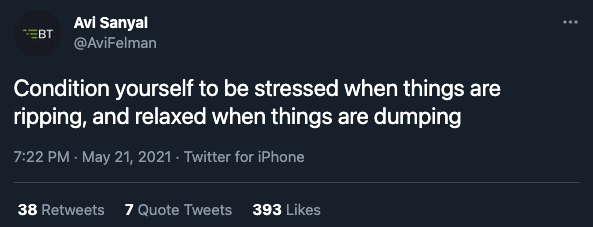

Tweet tip: keep an eye on how you balance yourself.

Meme moment: keep an eye on incongruities.

#HODLandEarn - Celsius x B21 Meme Contest: check it out.

COVID Crypto Relief Fund: made with help from B21.

Email eagerness: add us as a contact.

Get started: download the B21 Crypto app!