The currency of the old

Cryptic ball: ah, good old conservative profit-taking.

Roughly one month ago, on May 12th, we told you the musical shibairs game was getting dangerous and that the crypto market could crash earlier than our thesis expected. A couple of hours later, Vitalik Buterin rugged Shiba, bringing us all into the bearish state we're currently in. Back then, our analysis rested on the excessive memetic speculation and on the correlation between crypto with the stock market, which signals increased institutional participation. We explained that as these players are more rational, being perfectly content with a 2x or a 3x whereas retail investors are looking for a 100x before closing a position, it could be the case they were also faster to sell.

And it seems that was the case. Yesterday, news come out of a London-based fund that transformed $675k into $1.78 billon between December and April. Surely many more did so too. Their managers argued that traders, especially the young ones, would be away from the charts once the lockdowns lifted. This is the same reasoning behind the slow summer we've also been talking about - also known as Bitcoin's Seasonal Affective Disorder since 2015, when this pattern of decreased price activity in the northern hemisphere's summer was made known. What has all this to do with today? Well, as bitcoin is once again approaching the critical $30k support, it's time to zoom back and see where we are.

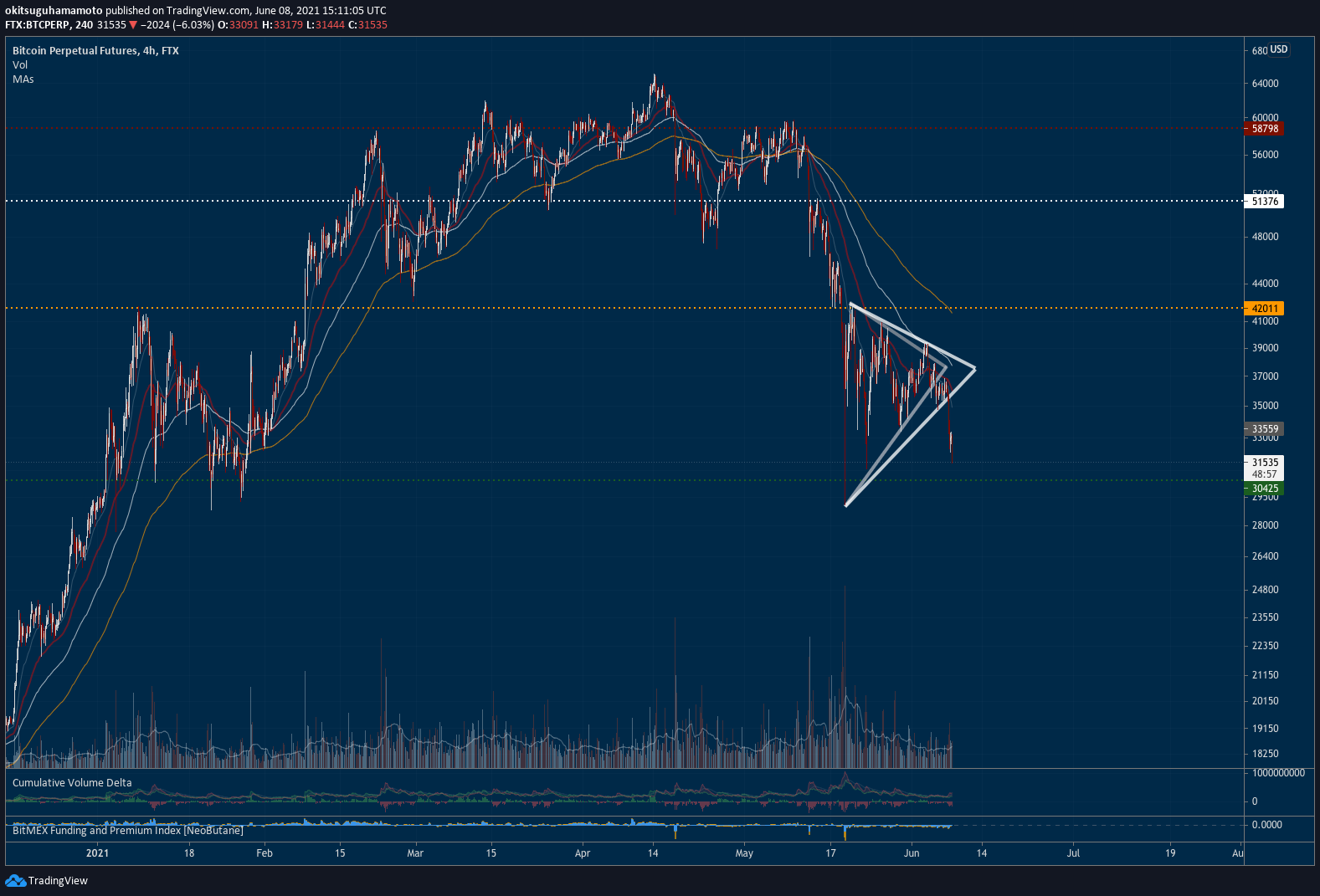

Chart art: ah, good old bearish patterns.

Market musings: ah, good old FUD.

Last night, traders dumped bitcoin below $35k, breaking the second possible bearish pennant that was holding the hope of apes - as you can see above. Note the original triangle, in grey, was already broken during the weekend, albeit not spectacularly, which means the meme lost its significance. Still, total market cap is down 13% over the past day with ether and major alts loosing some 15% to 25%. What happened and are there reasons to be fearful?

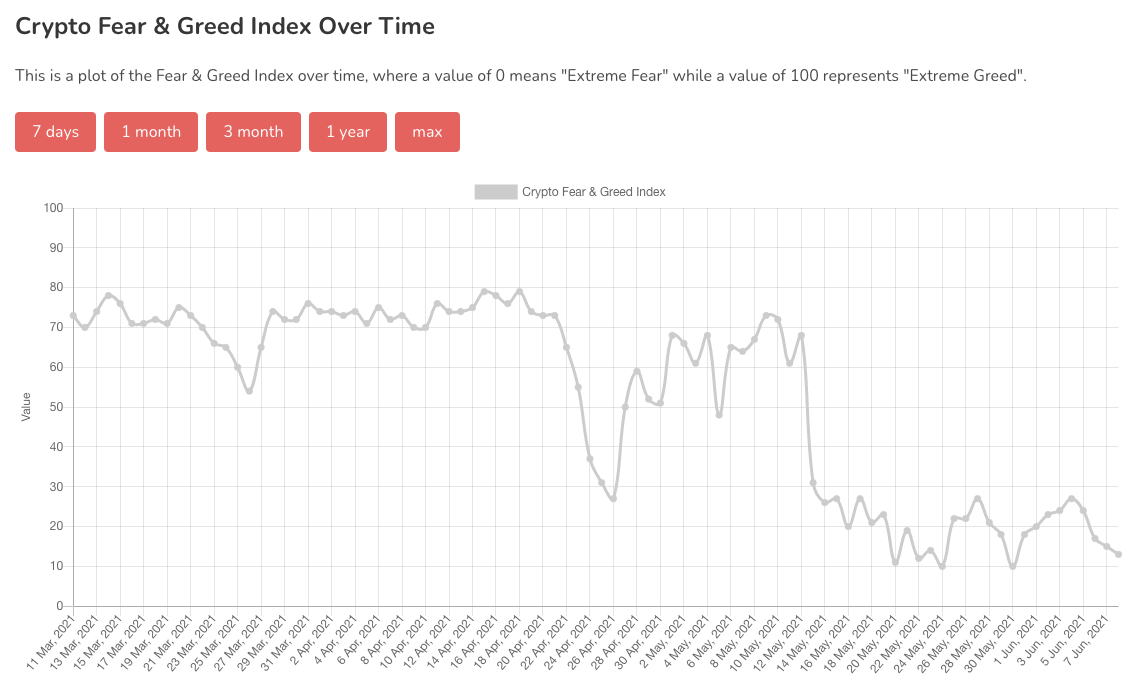

Note this dump hasn't happened due to overleveraged traders on the long side getting liquidated, as it did in May. Instead, it's a low-volume move, mostly led by miners selling their proceeds in the spot market, with some fresh leveraged shorts piggybacking to make a quick buck out of everyone's fear that the FBI had "hacked Bitcoin". Really? Anyway, it goes to show that, without a significant catalyst, it's unlikely bears can get much more than another test of $29k later over the next days, with the remaining alts following in relative terms. Especially because everyone is leaning bearish now, and markets with a stable number of participants tend to punish the will of the majority.

However, if BTC stays below $30k for a while this week, this would definitely change the forecast into a more aggressive bleed over the rest of summer (which funnily hasn't even formally started yet). So consider having a plan if that happens as it could dip all the way to $19k. In any case, it looks like a bottom will soon be in: either defined by the current fear, or by the capitulation associated with that new dip scenario. Meanwhile, don't try to catch falling knives and take this time to research and learn more about investing and about cryptoassets!

Visual block: ah, good old fear.

Three things: ah, good old ransomware.

- Justin Sun, Tron0's infamous founder, explains in a podcast about how he was indeed about to get liquidated on a $1 billion position during May's crash.

- Jeff Dorman, Arca's CIO, explains in a letter the reasons why the general public and financial journalists fail to understand what's driving meme stocks.

- Nikhilesh De, from CoinDesk, was the only writer to carefully explain the whole story behind the FBI recovering funds from a recent ransomware attack.

Tweet tip: ah, good old Trump.

Meme moment: ah, good old advertising.

The Desi Crypto Show: learn more about QuickSwap.

Email eagerness: add us as a contact.

Get started: download the B21 Crypto app!