It's the thrill of the fight

Cryptic ball: rising up, back on the street.

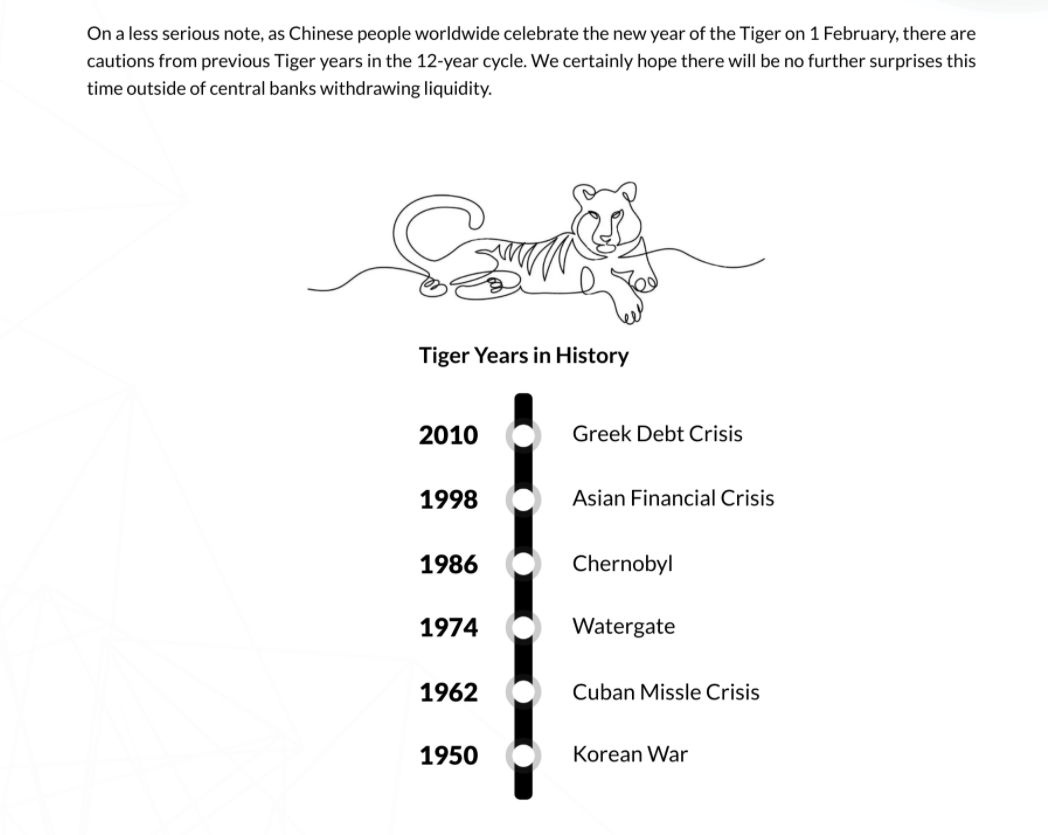

Oh, remember the time when the narrative that the Lunar New Year caused a dump in cryptoasset prices, as China would enter a two-week holiday and many speculated traders would opt to cash out and share their digital profits in traditional red envelopes? It's good that the relationship, if once mild, is now losing steam as there are larger forces at play. But, with January is coming to an end, let's see what those forces are and what can happen next.

To begin, this Saturday bitcoin failed to overcome the previous high at $38.8k, falling 5% over the rest of the weekend. Fortunately, alts across the board are showing decent strength today and bitcoin is trying to stalk bears in the night. But for those who are short to become nervous bitcoin really needs to print a higher high above $39k for the bounce to continue. Conversely, a fall below $36.7k would imply bears are in control and the next drop will surely put us below $35k - an anxiety-laden territory where anything can happen.

To add to the conundrum, many online are already calling for the end of this dip - or, as some even called it, the end of the bear market. Overall, I agree with Puru when he says we'll likely continue this relief rally for a couple more weeks before fresh FUD hits the tape in anticipation of the Fed's next meeting in March (e.g. raising the benchmark interest rate 0.5% instead of 0.25%, which is the priced-in hike). Still, while that analyst believes stonks (let's not even talk about alts) continue to be overvalued, they can remain overvalued for years more - provided inflation ceases to be a problem. Let's see how that unfolds.

Visual block: and he is watching us all with the...

Three things: don't lose your grip on the reads of the past.

- QCP Capital has launched a new monthly newsletter and it's a must-read. Check out the first issue of The Crypto Circular.

- Meltem Demirors has fact-checked a "letter to crypto miners" written by a group of US Senators. Curiously, it "contains numerous factual inaccuracies around bitcoin mining and its ESG footprint".

- Kadeem Clarke wrote about the "New Wolf of Wall Street: DeFi 2021 Overview and 2022 Outlook".

Tweet tip: you must fight just to keep them alive.

Meme moment: just a man and his will to survive.

B21 App: happy lunar new year.

Get started: download the B21 Crypto app!