Korea and swindlers

Cryptic ball: enjoy spring before summer arrives.

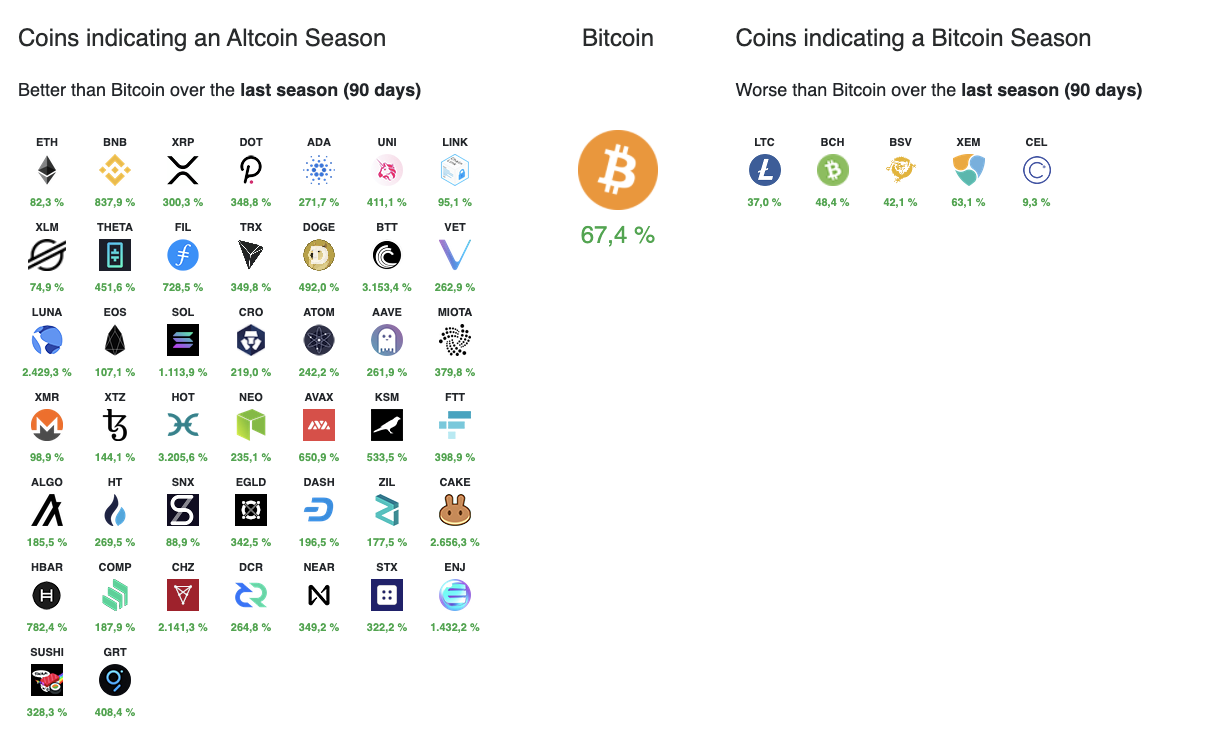

The total cryptoasset market cap has reached $2 trillion for the first time, after only hitting $1 trillion last January 7th. Bitcoin currently accounts for 56% of that, down from its January's peak of 69%. As you can see below, such low ratio wasn't seen since June 2019, further confirming our alt season call shared last week.

After all, even the moribund XRP pumped 50% over the past day. Remember, this token was once owned and is still partly managed by Ripple, a company charged by the US SEC last December for their fundraising practices back when crypto was the wild west. It has now reached a three-year high, and is nearly 5x above the SEC-induced lows. In other words, if XRP moons, any other alt can also bloom.

Meanwhile, some people are calling our attention to the fact the leader of the pack has achieved a record hash rate, and that's bearish for alts. But this indicator just means that Bitcoin mining - the process which rewards the owners of the computers running the original blockchain and confirming transactions with new orange coins - is more difficult and so the Bitcoin network is safer.

Furthermore, hash rate tends to follow price, but the opposite no longer happens. So, if you're looking for the moment when BTC will crush alts again, you should become acquainted with previous ETHBTC tops. If you remember another email from last week, we've explained alts tend to follow ether - so ETHBTC is a great proxy for alt season bottoms and tops. Watch out for that summer blues!

Chart art: an alternative April, indeed.

Market musings: do they know something we don't?

Yesterday we shared a chart showing the latest local high in bitcoin's Kimchi premium. And we just want to make sure that doesn't go unnoticed. Earlier today in Korea, bitcoin has reached an all-time high equivalent to 71k USD! Why? Such a spread occurs when demand for BTC is higher than in other countries.

The Korean won is a restricted currency, which often causes the BTCKRW pair to trade much higher than other fiat pairs, which can easily be arbitraged away. As Su Zhu, a well-reputed crypto investor, notes, even though the new high is still low compared to 2017, the premium can quickly escalate and create a feedback loop that compounds the speculative frenzy. That would be a good way to halt alts!

Visual block: everything is a remix.

Three things: learning is always profitable.

- Learn more about Bitcoin's on-chain indicators with this guide by Coinmetrics.

- Learn more about why most NFTs have "very little value" with Naval Ravikant.

- Learn more about why BTC isn't "speculative fervour" with Michael Saylor.

Meme moment: we bet Hockney will sell an NFT soon.

Get started: download the B21 Crypto app!