Thin Line Between Bulls and Bears

Cryptic ball: I keep a close watch.

This has been a fairly uneventful weekend, which is exactly what bulls needed. Volume was average and both bitcoin and ether managed to confirm last week's higher lows. This supports the narrative the bottom is in, at least while prices remain in the range described last Friday. Until that changes, there's not much to update. Especially as bulls and bears have equally interesting arguments, as summarised by Alex Krüger here and as shared in Glassnode's report in the last newsletter. What to do then?

We believe it's mostly about one's long-term investment thesis. Until a bullish or bearish trend is confirmed, recommending any trading bias is foolish, as you risk getting lost in the chop if you don't know what you're doing. In other words, this is a time to research and plan, unless you like trying to catch falling knives. Still, for the hopeful ones, you can note three things:

- Past situations where bitcoin was in such undersold conditions were indeed met with the kind of sideways activities bulls also need to recover momentum.

- While some volatility can be expected later tonight due to the monthly close, some analysts are expecting strong demand from funds in the next days.

- Lastly, don't fall for those calling out meme bearish patterns without analysing the whole picture. It's never about one piece of the puzzle.

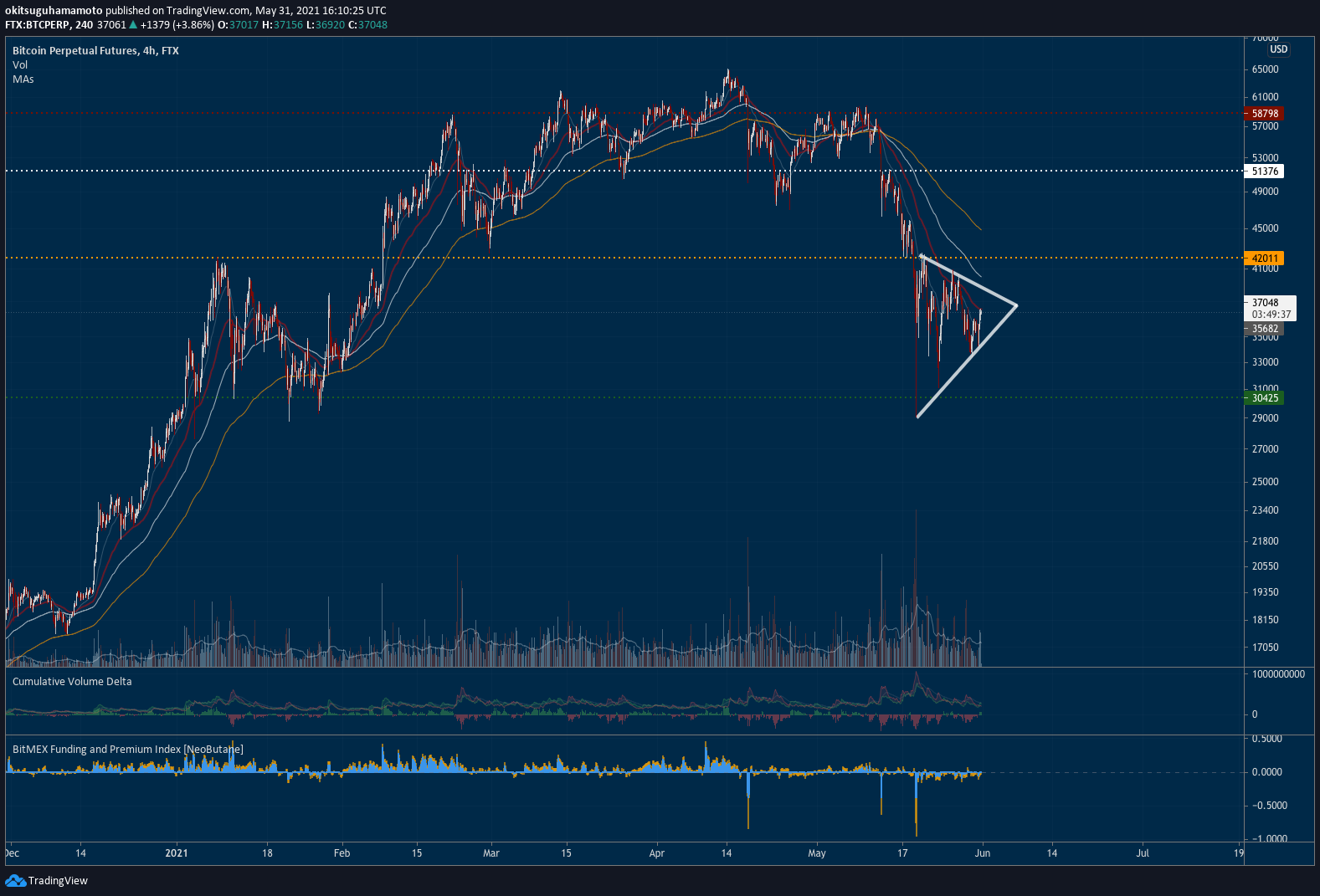

Chart art: I keep my eyes wide open.

Market musings: as sure as night is dark and day is light.

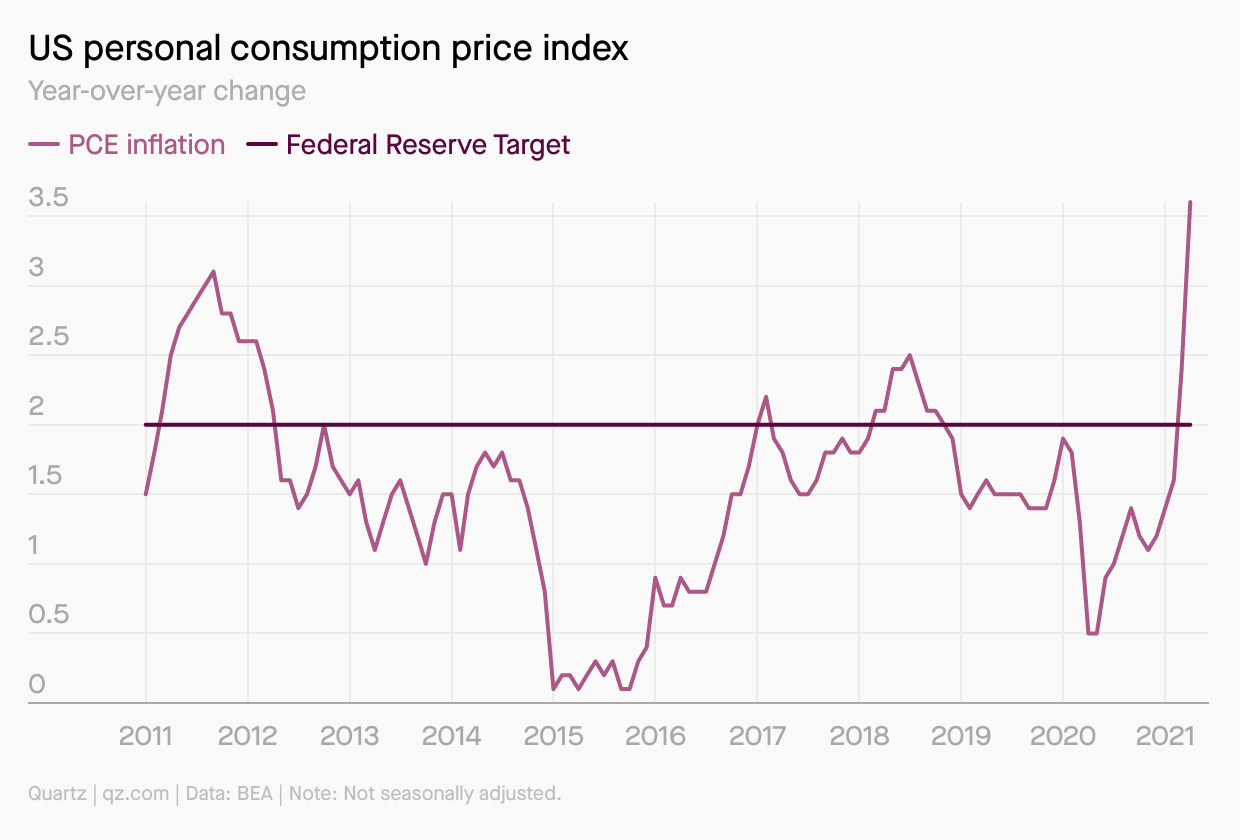

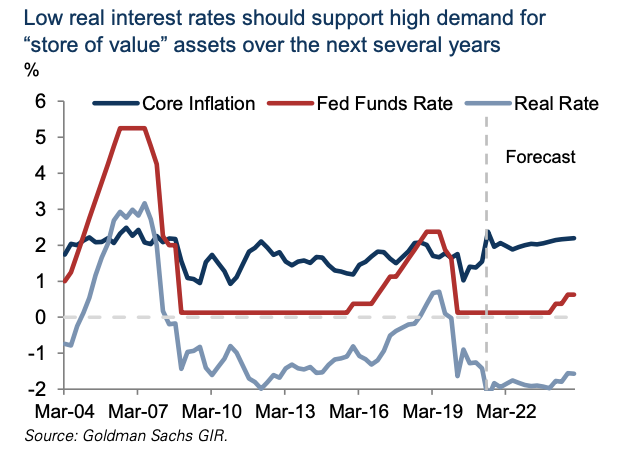

Another bright light you can consider is the general stock market. European stocks just hit a new high in anticipation of the economies open. China also had the best month in the year. And a pumping stock market would also fuel cryptoassets, as retail investors would likely feel they can risk a bit more in this brave new asset class. But it's all about US equities, right? Here, what you must watch is how the Fed reacts to the growing inflation, as you can see in the chart below.

April's increase in consumer prices was the strongest since 2008. So you can surely expect a major crash if tightening measures are adopted in response, i.e. by raising interest rates to cool down the economy. So far, the official answer is that this high levels are just temporary, due to Americans spending what they saved during the lockdown and supply shortages plaguing several industries, including plastics. But if prices don't stop increasing then investors will be more careful, meaning this crash will start looking lesse like the black swan dip of March 2020.

Visual block: I keep you on my mind both day and night.

Three things: It's a thin line between reality and FUD.

- India's Central Bank has ordered commercial banks to not caution their users against crypto trading, as some were doing. What a great piece of news!

- Goldman Sachs has released a redacted version of their recent research piece on crypto as a new asset class. The 41-page report is full of great interviews.

- Roshun Patel, VP of Genesis Trading, was interviewed on the recent crypto crash in an excellent Bloomberg podcast. Learn what really happened here.

Tweet tip: It's a thin line between a local and an absolute top.

Meme moment: It's a thin line between 100x and rekt.

Girl Gone Crypto: new interview with B21's Nitin Agarwal.

COVID Crypto Relief Fund: made with help from B21.

Email eagerness: add us as a contact.

Get started: download the B21 Crypto app!