Reminiscences of a Meme Token Operator

Cryptic ball: psychology is the same.

On April 5th we first considered the possibility we would see BTC suffer from a double top later in the month, followed by a dip to $40k. As the alts euphoria took over, we argued such top was out of the cards until at least July, with ether bulls driving the wagon in anticipation of the London hardfork that will take place before August - noting that such scenario was valid as long as ETH didn't break support below $2k. Well, in May the bitcoin double top came to haunt us all, and ether did break that support. So let's reevaluate our recent analysis to reassess our macro thesis for the months ahead.

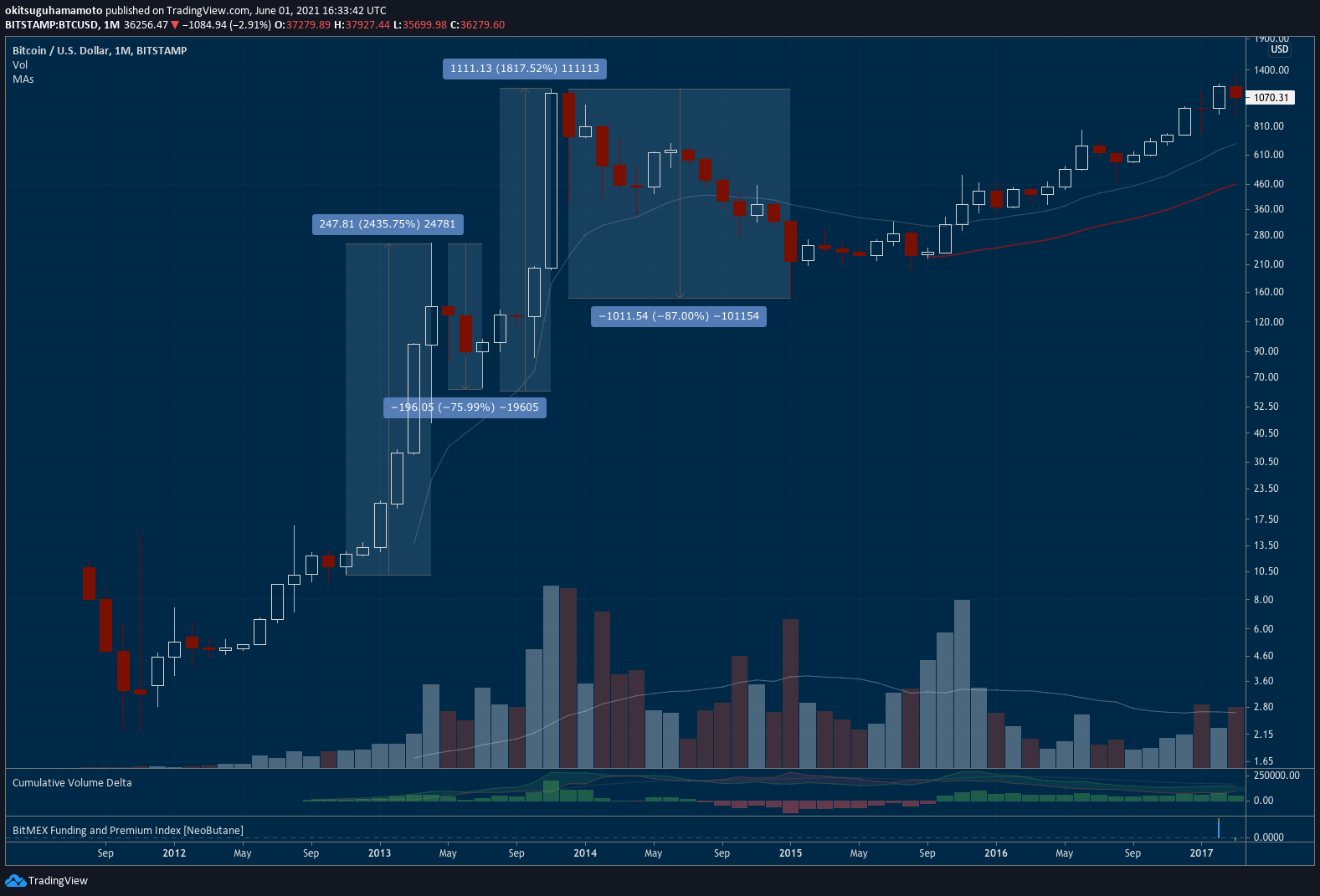

To begin, on April 19th, we also remarked that bitcoin had been pumping for six months straight - a quite rare event. The last and only time it had happened was in 2013, where BTC also found a top in April and fell 75% until July (after rising 25x in those six months though). The original cryptoasset then pumped 19x until December, surpassing $1k for the first time ever and doing 100x in a year. Only then did bitcoin started a year-long process to establish a new bottom.

Naturally, this time the multiples are smaller and the industry is more mature. But investor psychology is not that different. While some on-chain analysts believe this dip looks more like the COVID crash in March 2020, we must remind them it's not all about on-chain data. Still, on any case, it's possible we continue dipping and have some scary weeks ahead, in what overall will most likely be a summer of excruciating sideways trading until alts start popping. As usual, have a plan and take this boring time to prepare for the rest of the year, as bulls are not over.

Chart art: dips are the same.

Market musings: the inability to learn is the same.

The title of today's newsletter is from a book your correspondent was gifted in July 2017, but unfortunately only put his hands on later in 2018. Published in 1923, it tells the story of a Jess Livermore, a 19th century trader, and it's as actual as if it was written last month. In fact, the biographer quotes the trader as saying that another lesson he learned early "is that there is nothing new in Wall Street. There can’t be because speculation is as old as the hills. Whatever happens in the stock market today has happened before and will happen again".

More interestingly, and the reason we wanted to share it with you, is this other quote from Mr. Livermore: "there is nothing like losing all you have in the world for teaching you what not to do. And when you know what not to do in order not to lose money, you begin to learn what to do in order to win." While no single book should be a manual - but in particular this one, as the author first made his fortune with speculative 100x derivatives, just like in today's crypto casinos, and was then a market manipulator, just like today's crypto whales - we hope that it can at least bring some comfort in case you are still mulling over lost riches. Remember this is a new month and it's now time to embrace the summer chop.

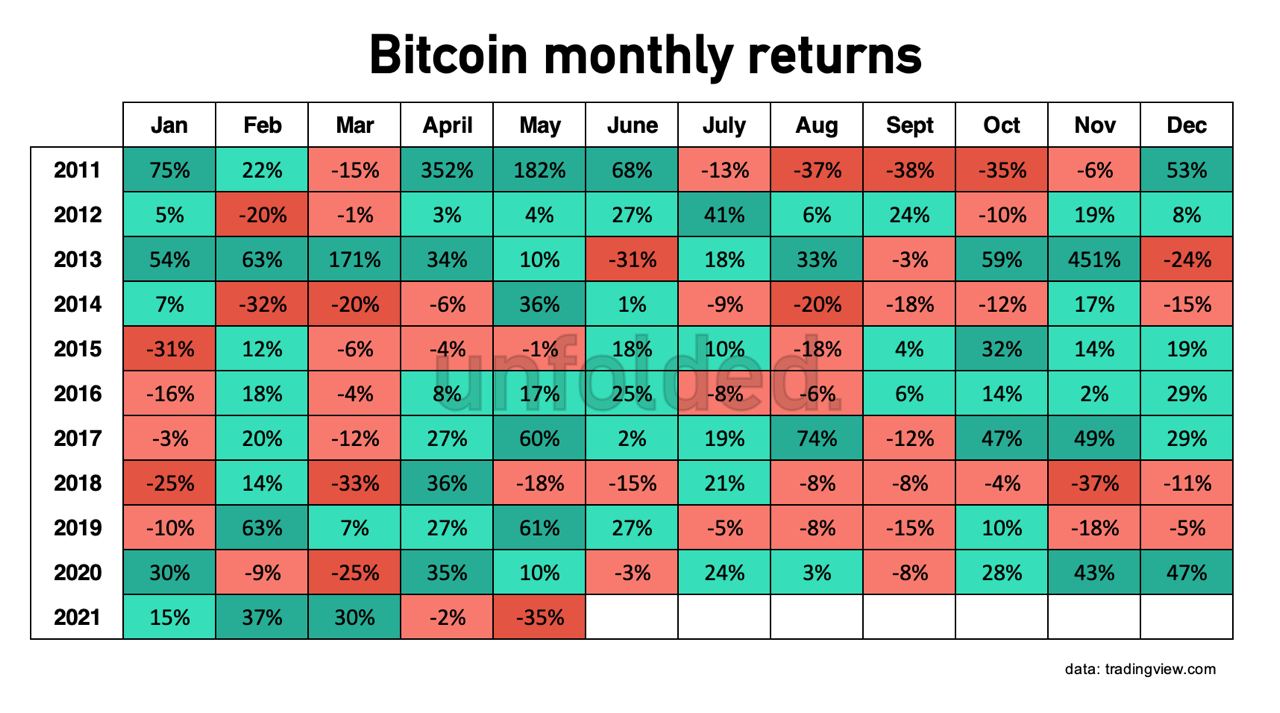

Visual block: returns are the same.

Three things: bulls are the same.

- Bitcoin 2021 Miami will be the largest BTC-related event so far. It starts Thursday but the Twitter hype is here. You can watch it on YouTube.

- Ethereum 2.0 will be the most bullish event for ETH, at least according to the last bulls standing. Learn about how ETH is the money of the internet.

- Market disturbances are the most exciting moments for crypto traders. Avi Felman covers how you can take advantage of future crashes. It's complex!

Tweet tip: price action is the same.

Meme moment: fears are the same.

Girl Gone Crypto: new interview with B21's Nitin Agarwal.

COVID Crypto Relief Fund: made with help from B21.

Email eagerness: add us as a contact.

Get started: download the B21 Crypto app!