El Salvador didn't save Bitcoin

Cryptic ball: Bitcoin hasn't bounced, yet.

We hope you've had a relaxing weekend, as not much happened in the crypto markets, given that many American whales were recovering from the weird Bitcoin Miami conference, its toxic talks and epic parties. That and the fact it's now clear the slow summer we've been talking about since early April is officially here. Yes, some selected alts continued to pump, but remember that over the next weeks - and hopefully a couple of months - the wider market will remain stale.

Why hopefully? Because if we see generalised action, i.e. bitcoin and ether moving and impacting the rest of alts, it's likely that such action will be negative, as the bearish bias is growing. For now, these leading coins are continuing to move sideways, which is not bad and means you can wait for a breakout in either direction to make a move. But the more they move like a crab without any significant bullish reaction, the more confidence bears have to start dumping.

Chart art: Bitcoin hasn't changed the world, yet.

Market musings: El Salvador hasn't recognised BTC, yet.

Take the case of the most interesting piece of news coming out of Bitcoin Miami: that the El Salvadorian parliament is going to validate legislation proposed by their somewhat authoritarian President that would make the Central American country the first to recognise Bitcoin as legal tender. Naturally, the crowd and Crypto Twitter cheered. But they forget Japan had practically declared Bitcoin as legal tender back in 2017, when it was declared a legally accepted means of payment.

Yes, maybe El Salvador will accept that you pay taxes in BTC instead of USD, which doesn't happen in Japan - that and some other interesting side-effects you can read about further below. But if the market didn't react to this and to other news it is because they weren't that important, right? Well, it's normal that boring (or bored) markets don't move on otherwise bullish news - even FTX's FTT token suffered the same fate after an historical sponsorship deal. So it's not that we don't find the news interesting, but that what matters is market reaction.

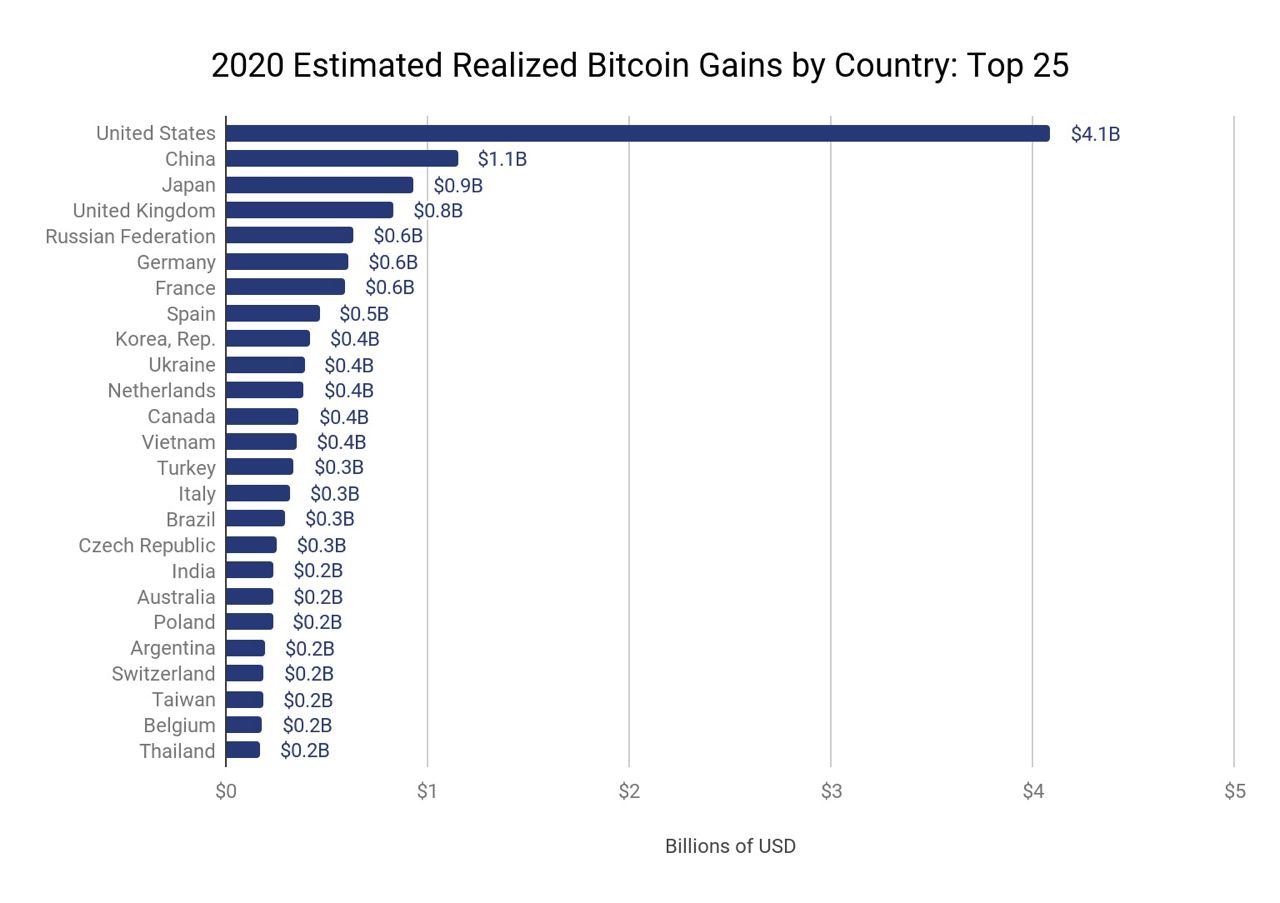

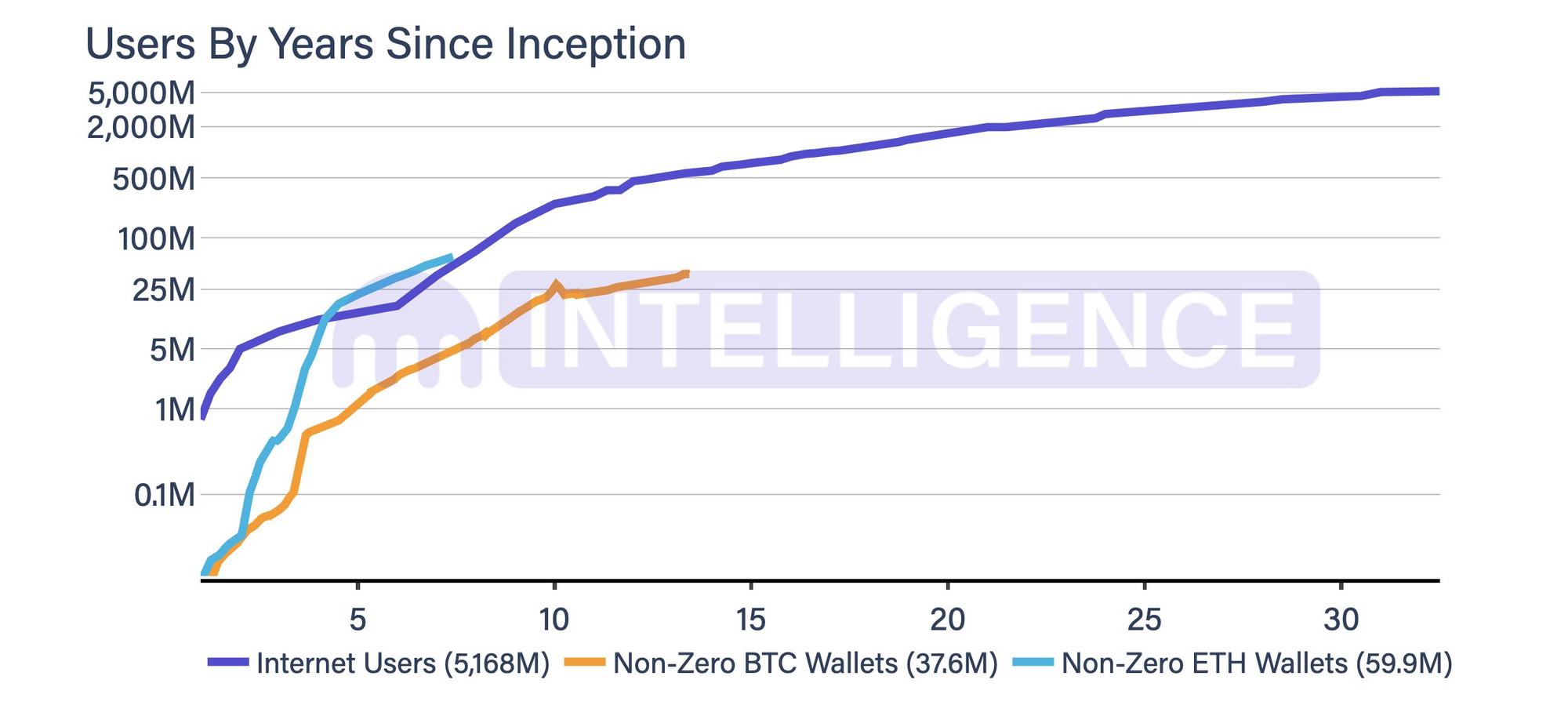

Visual block: the world hasn't reacted to BTC & ETH, yet.

Three things: blockchain scaling isn't solved, yet.

- Caitlon Long explains the potentially far-reaching benefits for Bitcoin that El Salvador recognising the cryptocurrency as legal tender can have.

- Alex Gladstein explains why it's "good that a questionable leader is promoting the use of Bitcoin in his country": it's a "Trojan Horse for freedom".

- Hasu and Su Zhu discuss Solana with Kyle Samani, who explains Multicoin's Capital long-term thesis for this Ethereum killer and its approach to scaling.

Tweet tip: the USD's reputation isn't tarnished, yet.

Meme moment: inflation isn't a problem, yet.

The Desi Crypto Show: learn more about QuickSwap.

Email eagerness: add us as a contact.

Get started: download the B21 Crypto app!