Low-hanging taproot

Cryptic ball: just a mini bear trap.

The weekend is here and it looks like the market got the small flush it needed to calm down over-leveraged bulls. Bitcoin dropped just below Wednesday's aggressive wick, down at $62.5k, and bounced back. This recovery even started exactly a few minutes after the US SEC rejected VanEck's application for a spot-based Bitcoin ETF, suggesting this risk was priced in. The bounce has created a double bottom at the same accumulation range that it has been trading since October 15th - which will reassure traders that there's strong support here.

The rest of the market is also recovering rapidly and it feels like we're out of the woods now. Just keep an eye on bitcoin failing to recover $66k this weekend as a sign that most alts may continue to trade sideways until the next big move. Conversely, if ether falls below $4.5k again it will surely go down to $4.1k - where the next key moving average is, a place bulls must bid to defend this run. Because one thing is certain, such a move will come soon, be it up or down.

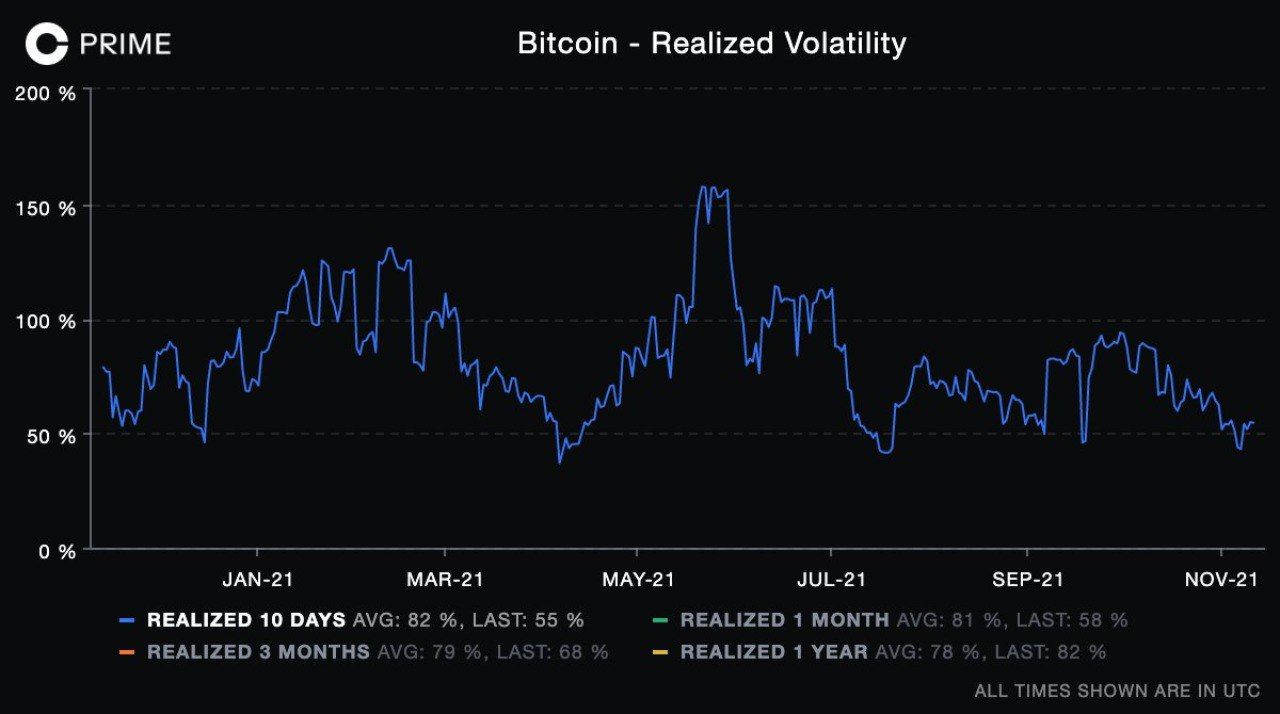

As you can see in today's visual block, bitcoin's realised volatility has been quite low for the past month and has just hit this year's bottom. While low volatility typically implies confidence in a given market, it is also the case that traders - especially in crypto - tend to assign a higher probability that a sudden move will take place after such periods of relative stability: a "volatility squeeze".

And, as I've been briefing you, whales like to play with significant events to compound their chances of moving the market. And Taproot's activation is looking like the best opportunity to shake things up (or down, as explained this Wednesday, but that's not what I'm anticipating). Remember Bitcoin's Taproot update will happen this Saturday or Sunday, according to the current rate of blocks being produced by the Bitcoin network, whenever block 709,632 is mined.

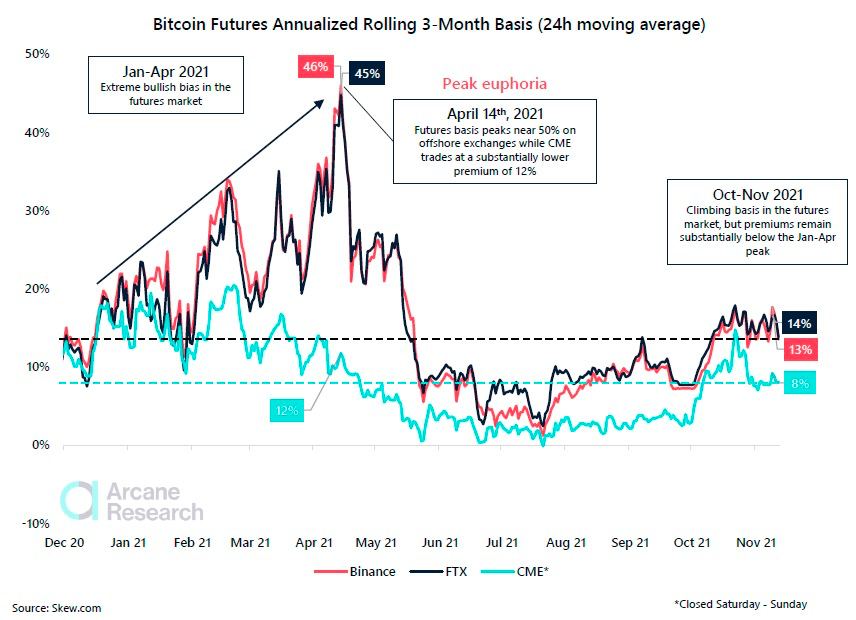

Overall, I remain bullish. One of the world's most popular financial blogs is just now talking about this, suggesting the upgrade is not priced in. Social chatter about BTC has reached an all-time low since May, according to Santiment's behaviour analysis data, further indicating most people are looking at the next big dog coin instead of the original cryptoasset. So, this indeed looks like a textbook chance for Bitcoin die-hards to pump it, attempting to leave alts behind. Lastly, check today's chart by Arcane, which clearly shows the market is healthy. GW!

Visual block: gradually, then suddenly.

Chart art: a healthy market.

Three things: one is a must-read, but which?

- Harvard Business Review has a great guide for "how NFTs create value" in case you need to share something with that sceptical friend of yours.

- Arthur Hayes is back with a massive post about his view on global central bank policy. In brief, the legend believes we can pump through 2022!

- NYDIG, part of a multi-billion dollar financial services firm from New York, published an excellent 6-page guide on Taproot. Check it out.

Tweet tip: a clear sign.

Meme moment: another one.

B21 Card: powered by Visa.

Get started: download the B21 Crypto app!