Unmerge

Cryptic ball: not so on the verge.

As expected, we haven't dumped much and both stocks and crypto seem to be consolidating for the next leg up. That's good, especially considering that many were expecting the FOMC meeting minutes shared today to be more bearish.

- To be fair, the Fed clarified it will continue to hike rates in the near future, but it also said it "would become appropriate at some point to slow the pace of policy rate increases while assessing the effects of policy adjustments".

- That means that if core inflation (i.e. consumer prices except for food and fuel) remains under control, the path to taming inflation should be less aggressive than it has been so far - which is what the markets need to hear (or read!).

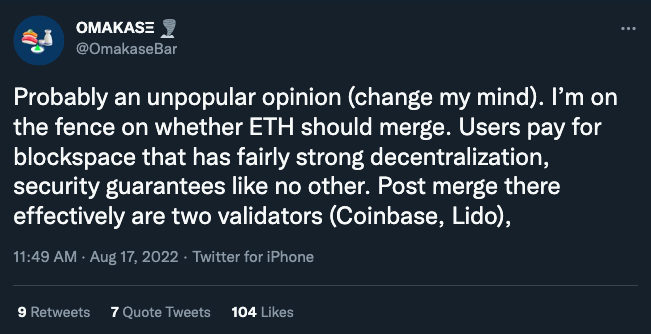

- Meanwhile, Ethereum's Merge is becoming clouded by controversy - again. What's being called the "Biggest Structural Shift in Crypto History" is now being seen as even riskier than anticipated given the centralisation threat.

- In brief, the issue is how powerful Lido and Coinbase are due to their staking services - even if Brian Armstrong confirmed they would rather shut down Coinbase's staking services than comply with OFAC sanctions.

Still, this is creating some uncertainty and I'm expecting this narrative to become convoluted as we approach the Merge's target date of September 15th or 16th. Let's keep following this matter attentively as this will be a make-or-break moment!

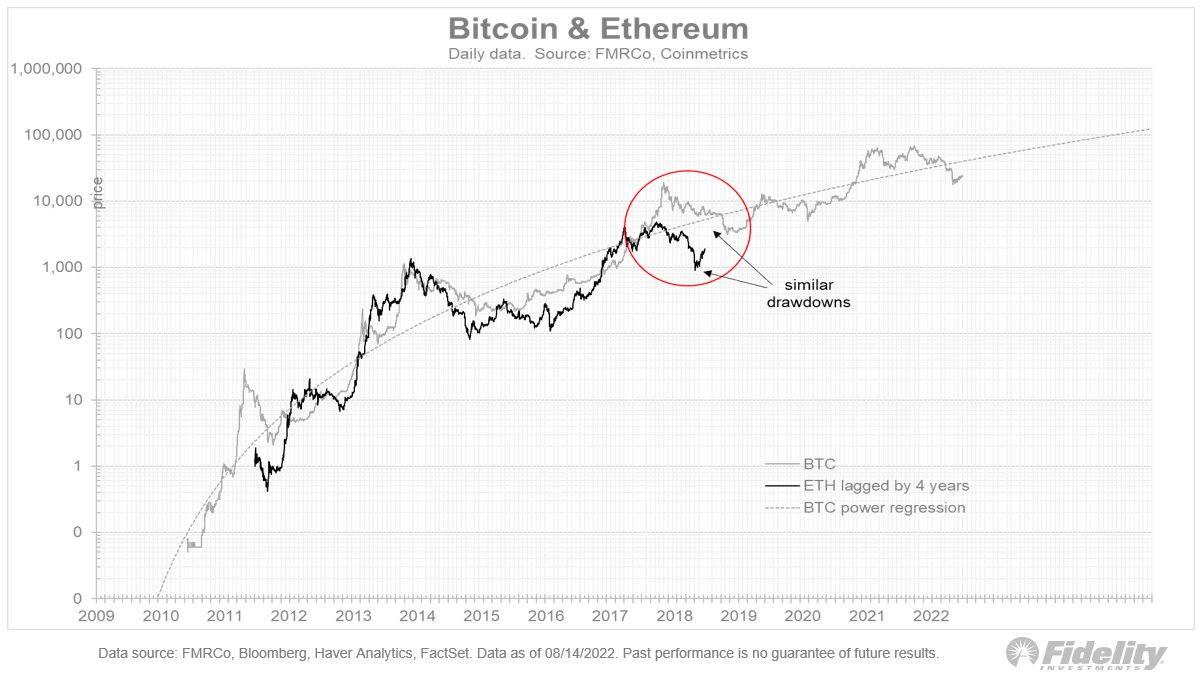

Chart art: not so different.

Three things: not so likely or good.

- Lane Rettig shares "seven possible scenarios for the Merge".

- Dylan LeClair and Sam Rule analyse "the Merge's risks and flaws".

- Arthur Hayes explains how to think about and trade the Merge.

Tweet tip: not so unpopular.

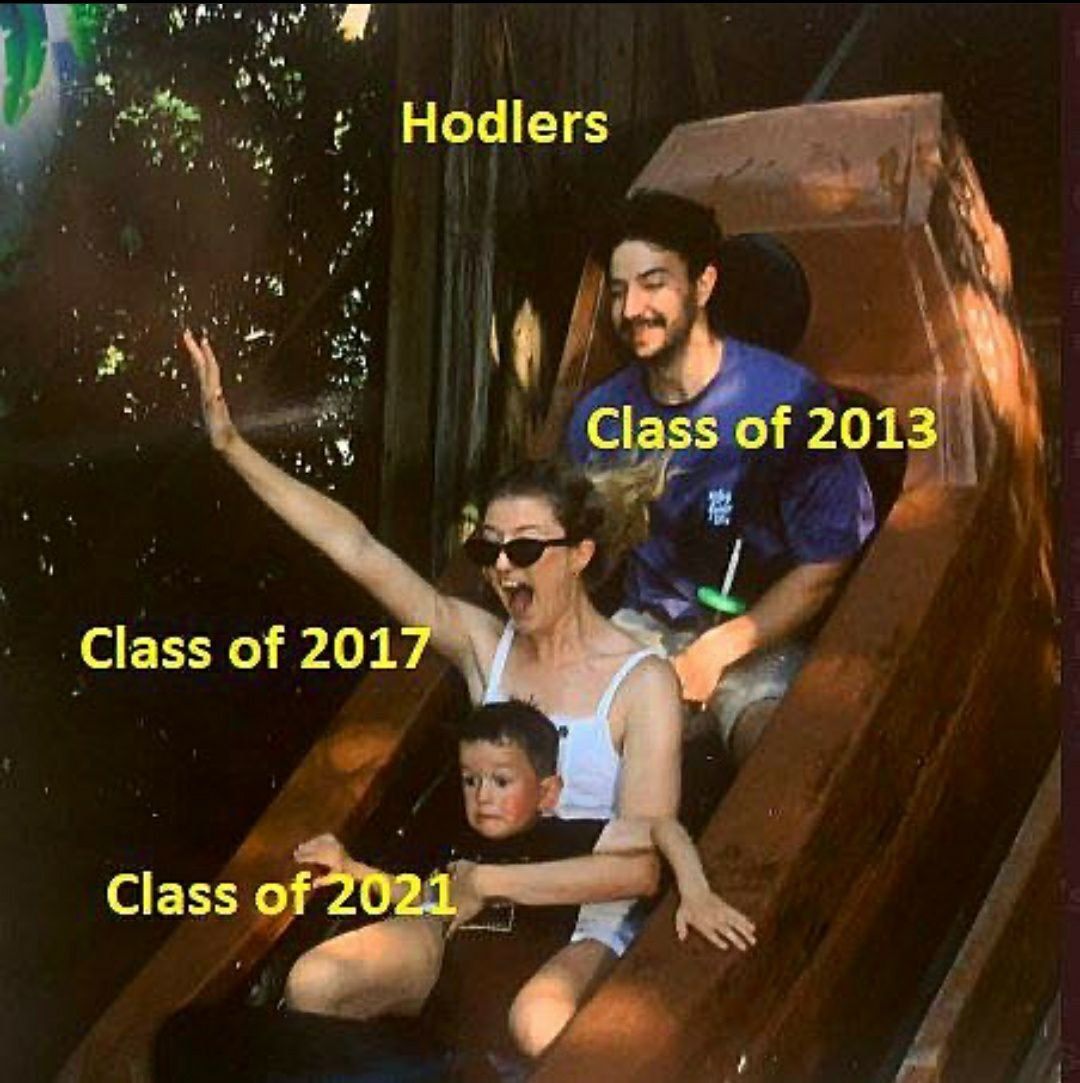

Meme moment: not so unfazed.

FV Bank: new monthly newsletter.

Get started: download the B21 Crypto app!