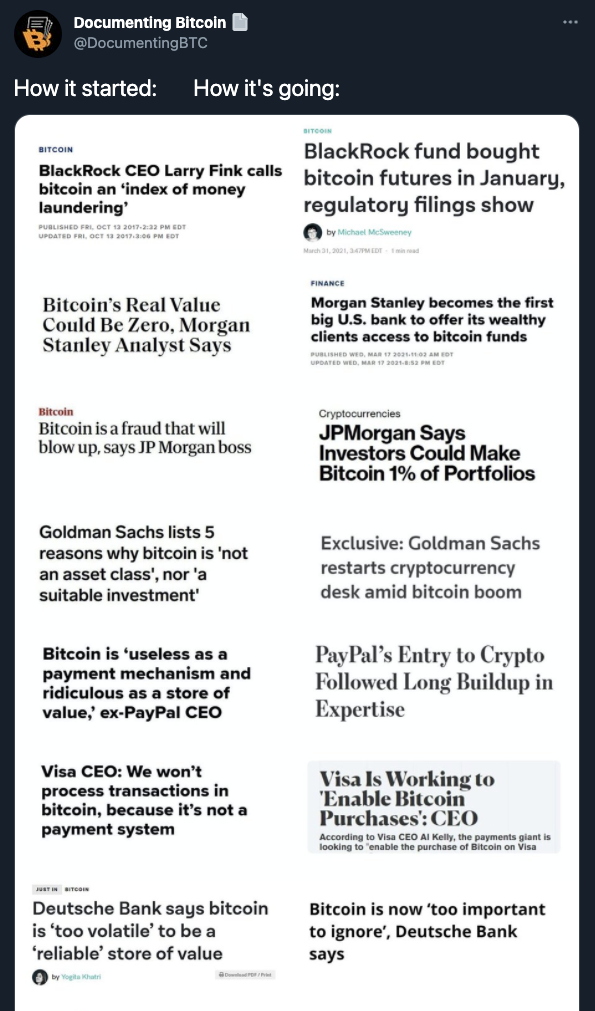

Wall Street Frets

Cryptic ball: first test passed.

Practically everything except bitcoin has bounced over the past 24 hours, following yesterday's scare with Coinbase stock going public for the first time - which pulled down several tokens for at least a while. As it as often occurred with recent direct listings, as you can see below, price quickly rises above the initial reference and the stock is then dumped over the week. For now, after dumping 30%, COIN seems to have found a floor around $330, which still implies a valuation of $86 billion!

So, as things are smooth on that front, let's continue talking about the current alt season. First, the most important thing we need to know is that the euphoria associated with the world's most popular cryptocurrency app hasn't - yet - overflowed into a generalised cryptoasset frenzy. Yes, bulls are wild and every day we get more people reminding us about the crypto bubble. But, this "watershed event" hasn't been comparable to previous bull market moments of jubilation.

Conversely, it seems more akin to 2017's bitcoin civil war - which peaked in July and birthed the infamous Bitcoin Cash project. This conflict, together with the ICO craze, attracted plenty of interest into the space. The difference was that once the war ended, the new paradigm provided clarity to the industry, allowing more risk-averse investors to get exposed to the original cryptoasset, which helped fuel the existing bull run for some more months. Could that be what's happening now?

Chart art: will coinbase keep on falling?

Market musings: ether keeps leading.

Secondly, note that ether has reached another all-time high of nearly $2,500 today. Exactly two weeks ago, when ETH was below $2k, we warned you that once it started moving that would be the sign that alts would pump in tandem, and ether would lead their way. Now that the second most popular cryptoasset is in price-discovery mode, note that its current trend can continue uninterrupted until summer starts - provided that ETH doesn't fall below $2k again (for now).

This bullishness regarding everything Ethereum has been propelled by its blockchain's latest peaceful hard fork, dubbed Berlin, which was implemented today. This is because, among others, it incorporated an improvement proposal for reduced gas costs, which lower the fees one needs to pay for using the network. As the high-fees debacle will continue until June or July, you can expect traders to keep buying this rumour until then. After, it's all about selling those news!

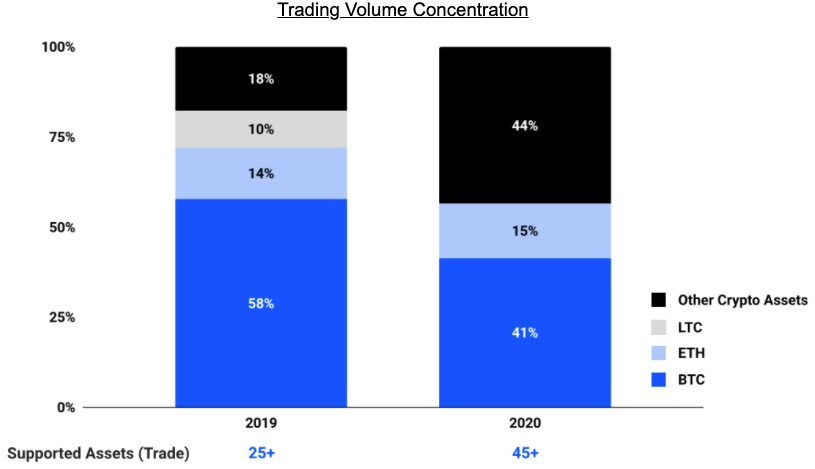

Visual block: come for the BTC, stay for the alts.

NFT naan: value isn't just about scarcity.

One of the most interesting use cases for non-fungible tokens is art. There's a big debate around whether it is "only good for already-established artists" or if it's a positive bubble that helps funding a whole new generation of creators. To further understand the topic, we strongly recommend this piece about Nigerian artists and NFTs. Let's hope the high valuations don't lead artists astray!

Three things: NFTs are poorly communicated.

- Are you a startup founder struggling with communicating your business idea? Find some inspiration in Brian Armstrong's story!

- Do you believe NFTs are contributing to global warming? Worry not, Nic Carter is always ready to settle a debate about crypto's energy use. Must-read!

- Interested in knowing how NFTs can help make journalism better? Simon de la Rouviere has an interesting proposal. It's all about combining pieces of web3!

Meme moment: even reddit's WSB has joined the party.

Email eagerness: add us as a contact.

Get started: download the B21 Crypto app!