Back to greed

Cryptic ball: backpedalled agreement.

As expected, the crypto market continues to range. Total market cap is stagnant, even if new alts keep pumping every day. Today's winner is SOL, which suffered a lot of stress after falling 70% from November's top. But what's next?

- SOL appreciated 12% today and is up 30% on the week - while bitcoin and the average token is up around 12% since Monday. Solana's currency has apparently conquered the $120 resistance and if that's confirmed it shall pump towards $150 - provided macro or bitcoin don't ruin the party.

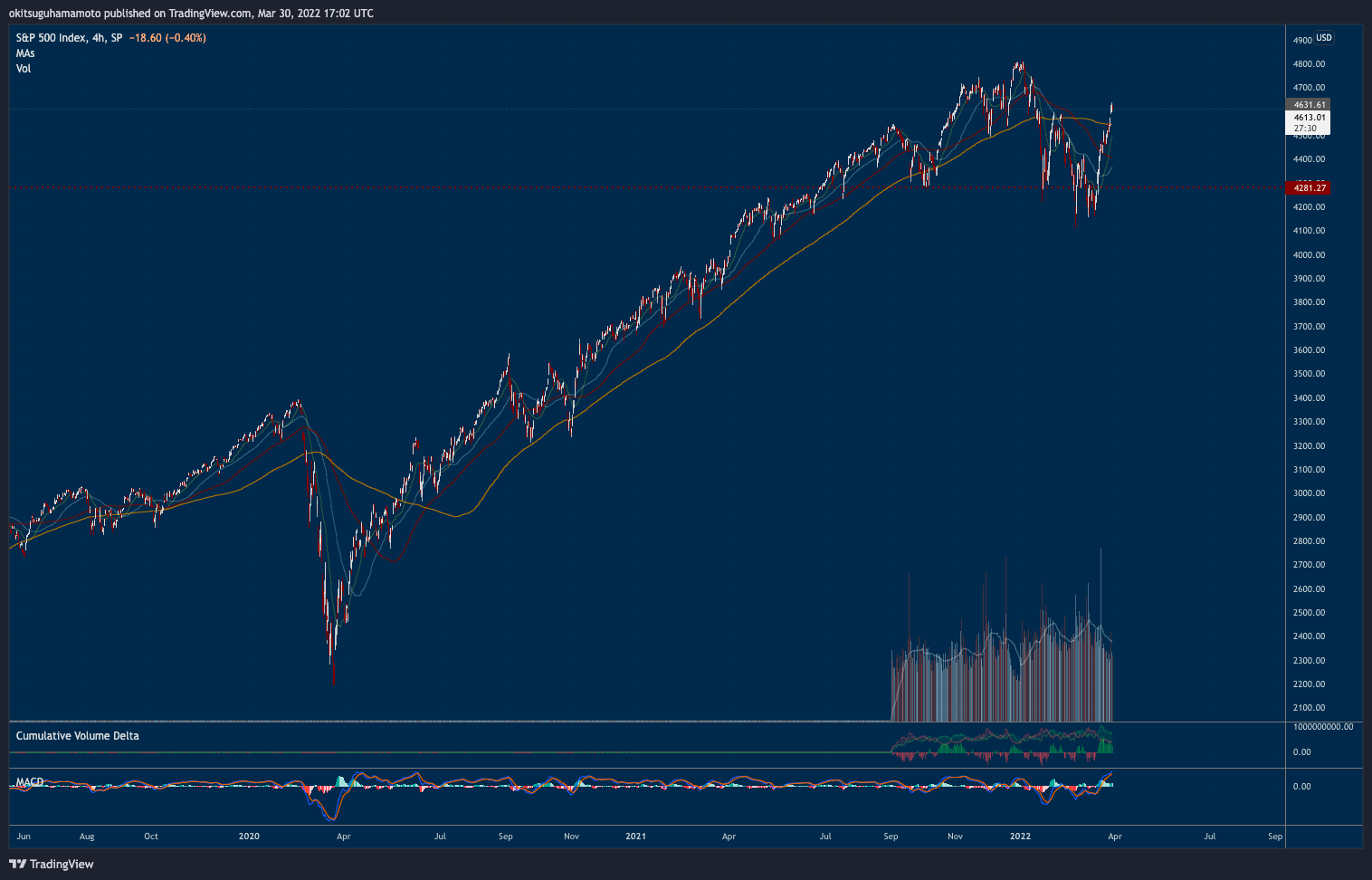

- The S&P 500 finally overcome the 200-period resistance on the 4-hour chart, the level which most sustained the stocks bull run since COVID hit. Yes, equities are slightly down today but that's normal after the steady gains.

- Again, I remain optimistic for April but note tomorrow is the quarterly and monthly close, a period often associated with volatility as institutions roll over futures and options contracts tied to a specific month or quarter.

With this new, mildly greedy environment, I don't expect bears can do much harm, but note yesterday's war-related optimism must be taken with a grain of salt, as it seems Russian officials were not happy with the peace talks after all.

Chart art: back to bullish territory.

Three things: back to gem hunting.

- 0xRusowsky created "an investment framework that will help you own your attention back".

- Chris Powers wonders if "DeFi innovation has stalled".

- Vitalik Buterin wrote about "the roads not taken in Ethereum's development".

Tweet tip: back to jumping.

Meme moment: back to FOMO.

FV Bank: meet us in Miami.

Get started: download the B21 Crypto app!